ESG Investing

Our mission is to help our clients meet their investment objectives and enable them to invest across a spectrum of returns, risk and ESG objectives.

With our rich heritage of combining investment excellence with a culture of accountability and social responsibility, ESG considerations are an integral component of the value proposition that we offer our clients.

Integration

Incorporating ESG issues into the investment process is underpinned by the belief that it will improve the financial resilience of the portfolio over the long-term by generating more stable, sustainable long-term returns. Performance in ESG-related areas can impact financial strength, the risk of ratings downgrades and valuations. For these reasons, we diligently analyze how material ESG issues can affect a company’s long-term outlook.

ESG considerations enhance our investment process by:

|

Deepening our fundamental research and analysis

|

|

Broadening our relative value perspective

|

|

Strengthening portfolio construction

|

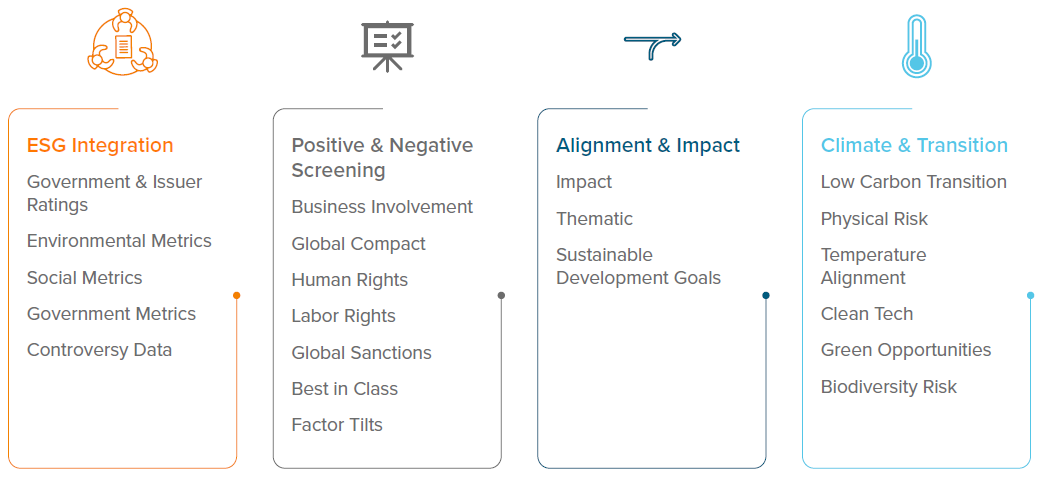

Capabilities

Integration of material ESG considerations is core to our fundamental approach. Our investment in tools, people and processes allows us to offer client-directed customization and sustainability-focused portfolio solutions.

Memberships

We partner with like-minded market participants that advocate for improvements on shared ESG interests, including better disclosures, increased transparency and greater alignment with shareholder interests.

Climate-related industry groups

- Carbon Disclosure Project (CDP): Helps companies and cities disclose their environmental impact. Voya has been a signatory since 2017.

- RE100: Drives commitment to achieve 100% renewable electricity. Voya is an original member since the network launch in 2015.

Other ESG-related organizations

- Association of Corporate Citizenship Professionals: Advances the field of corporate citizenship and provides valuable peer connections, education and resources for its community of purpose-driven companies.

- CEO Action for Diversity & Inclusion™ (CEO Action): Works to advance diversity, equity and inclusion in the workplace; Voya was one of the original members in 2017 and joined the CEO Action for Racial Equity fellowship program when it launched.

- CEO Commission for Disability Employment: Seeks to raise awareness of the untapped potential of people with disabilities and works to ensure that people with disabilities achieve and maintain equal access to meaningful employment. Voya is a founding member since its launch in 2020.

- Council of Institutional Investors: Provides a voice for effective corporate governance, strong shareowner rights and sensible financial regulations that foster fair, vibrant capital markets. Voya IM became a signatory in 2019.

- Disability: IN: Empowers business to achieve disability inclusion and equality. Voya joined the organization in 2017.

- Seramount - Diversity Best Practices: Provides research, resources, publications and strategies on how to implement, grow, measure and create programs designed to support DEI’s role as a business driver and a key element in a company’s culture. The Diversity Best Practices team includes researchers, practitioners, consultants and industry-focused diversity relationship managers. Leveraging the resources at Diversity Best Practices can help you achieve your team’s diversity and inclusion goals.

- Financial Services Roundtable for Supplier Diversity: Organization comprised of regional, national and global financial services companies with a formalized supplier diversity initiative that seeks to advance small and diverse-owned business inclusion within the financial services industry. Voya has been a member since 2022.

- Georgia Hispanic Chamber of Commerce: Organization that promotes and supports the domestic and international economic development of Hispanic businesses, and individuals, and to serve as a link between non-Hispanic entities and the Hispanic market. Voya has been a member since 2024.

- Global Reporting Initiative (GRI): Provides best practice for impact reporting, with the mission to deliver the highest level of transparency for organizational impacts on the economy, the environment and people. Voya joined the GRI GOLD Community Standards Pioneers Program in 2016.

- Investment Company Institute (ICI) ESG Advisory Group: Seeks to encourage adherence to high ethical standards, promote public understanding, and otherwise advance the interests of funds, their shareholders, directors and advisers. Voya IM joined the ESG Advisory Group in 2020.

- Investment Stewardship Group (ISG): Seeks to establish a framework of basic investment stewardship and corporate governance standards for U.S., institutional investor and boardroom conduct. Voya IM has been a signatory since 2019.

- Loan Syndications and Trading Association (LSTA) ESG working group: Focuses on ESG developments in the loan market, which includes ESG integration as well as the development and evolution of ESG loan products. Voya IM joined the working group in 2019.

- National Minority Supplier Development Council (NMSDC): Advances business opportunities for certified minority business enterprises (MBEs) and connects them to corporate members. Voya has been a member since 2018.

- Out & Equal Workplace Advocates: Provides LGBTQ+ executive leadership development, comprehensive DE&I training and consultation, and professional networking opportunities that help build inclusive and welcoming work environments. Voya joined the organization in 2019.

- Securities Industry and Financial Markets Association (SIFMA) Asset Management Group (AMG) ESG Taskforce: Provides views on U.S., and global policy and to create industry best practices. Voya IM became a member of the ESG taskforce in 2018.

- United Nations Global Compact (UNGC): Encourages companies everywhere to align their operations and strategies with ten universally accepted principles in the areas of human rights, labor, environment and anti-corruption, as well as to support UN goals and issues embodied in the Sustainable Development Goals (SDGs). Voya IM joined the UNGC in 2022.

- UN Principles for Responsible Investment (PRI): Aims to help investors integrate ESG considerations into investment decision making and supports sharing best practice in active ownership. Voya IM has been a signatory since 2017.

Environmental, social and governance (“ESG”) factors can impact the investment risk and return profiles of our investments. Investing based on ESG factors may cause a strategy to take risks or forego exposures available to strategies or products that do not incorporate ESG factors, which could negatively impact performance. There is no assurance that investing based on ESG factors will be successful. Past performance is no guarantee of future results.