Voya and Allianz Global Investors: A Strategic Partnership

Voya Investment Management (Voya IM) is committed to being the partner of choice for U.S. Offshore financial professionals and their clients. Thanks to our global strategic partnership with Allianz Global Investors (AllianzGI), we provide international clients with access to a comprehensive range of solutions across all major asset classes in the AllianzGI UCITS family – including funds sub-advised by AllianzGI and Voya IM. Working together, we deliver the strength of two leading asset management firms, and the support of a dedicated team of experienced professionals. It’s a strategic partnership built around your needs, and we look forward to working with you.

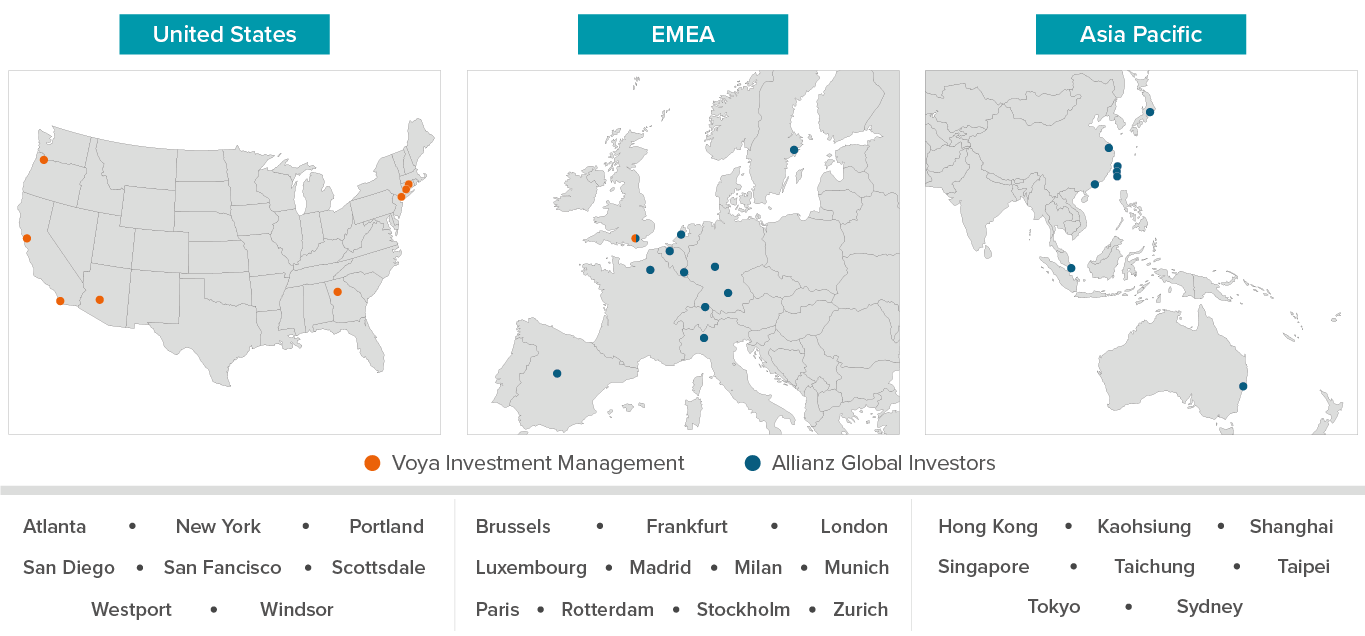

AllianzGI will distribute Voya IM’s investment strategies through its network of more than 500 relationship managers in 19 locations across Europe and Asia Pacific, broadening our ability to serve the needs of investors globally. |

AllianzGI U.S. has transferred select investment teams and assets to Voya IM, bringing competitive strategies that complement our existing lineup. Additionally, Voya will offer strategies from Allianz Capital Partners and other private markets capabilities to certain U.S. clients. |

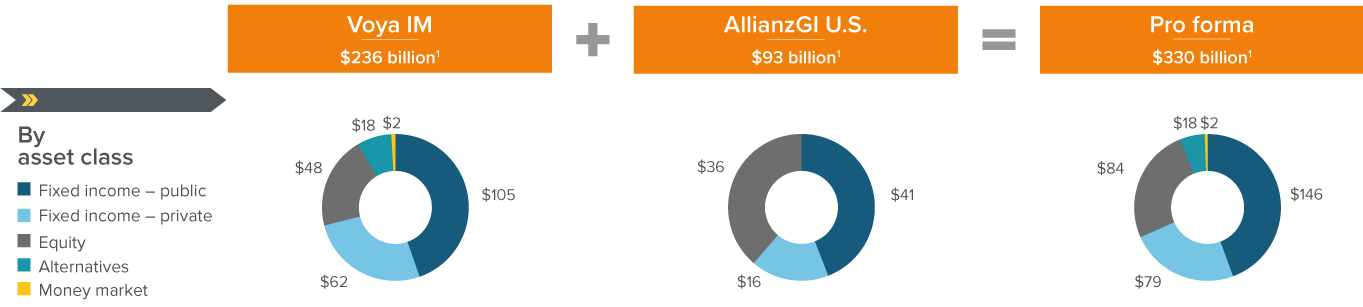

Adding international and retail clients from AllianzGI strengthens and diversifies Voya IM's assets, growing our AUM by nearly 40% to $330 billion on a pro forma basis as of 06/30/2022.1 |

Expanded Global Presence

Voya IM strategies will be distributed internationally through AllianzGI, one of the world’s leading active asset managers, with 19 locations across Europe and Asia Pacific.

Enhanced Capabilities

Voya IM has integrated several highly skilled investment teams from AllianzGI U.S., complementing our existing team in terms of cultural fit, investment philosophy and dedication to client needs. A partial list of capabilities is shown below. Additionally, Voya will offer strategies from Allianz Capital Partners and other private markets capabilities to certain U.S. clients.

|

Income and Growth San Diego, CA

|

|

|

Equity San Francisco, CA

|

|

|

Private Placements Westport, CT

|

|

|

Private Markets and Real Assets via AllianzGI |

|

Increased Scale and Breadth

As a result of the transaction, Voya IM’s AUM increases by $93 billion to $330 billion as of 6/30/2022.1

1 As of 06/30/2022. Reflects pro forma assets of Voya Investment Management and select strategies of Allianz Global Investors U.S. integrated as of 07/25/22. Voya Investment Management external client assets are reported on a market value basis. General account assets of approximately $39 billion are reported on a statutory book value billing basis consistent with revenues earned.