Voya Senior Loan Bank Advisory Program

Voya understands the delicate balance between planning, growth, risk management and the success of any bank initiative. With each client we plan to the end – not just based on our perspective – but on your expectations, resources, limitations and with a disciplined focus on practical banking standards.

Good commercial loans are hard to find, and if your bank is faced with excess funds that need to be put to work beyond local real estate loans and Treasury securities, or if you need to rebalance the loan portfolio toward C&I loans, the Voya Senior Loan Advisory (the “Program”) can help. The Program can give your bank access to the $1.39 trillion syndicated senior loan market, commonly called the leveraged loan market.1

Voya Investment Management, the asset management business of Voya Financial (NYSE: VOYA), is an established, experienced member in this asset class. The Program was developed to introduce select community and regional banks to the leveraged loan market through a mentoring, co-operative collaboration. Leveraged loans can offer potential advantages to your bank, including increasing your C&I loan portfolio, providing higher interest margins, enhancing profitability and diversifying credit risk. The Program will help your bank take advantage of these potential benefits by creating a syndicated loan credit policy, underwriting leveraged credits, and providing support to obtain Board and regulatory approvals and training personnel.

Two Distinct Programs Offered to Serve Banks

|

Core Program (single bank)

|

|

Shared Portfolio Program (group of banks)

|

A Designed Syndicated Commercial Loan Portfolio May:

- Increase total C&I loans and maintain a desired concentration

- Help manage interest rate risk with variable rate loans

- Enhance profitability

- Diversify risk

- Foster in-house expertise in C&I lending

Voya Will Help You:

- Plan and implement a loan growth initiative from start to finish

- Create a compliant syndicated loan credit policy

- Obtain Board and regulatory approvals

- Obtain access to syndicated loans

- Underwrite credits and provide efficient tools and processes

- Train your personnel

- Provide risk management support for the life of each loan

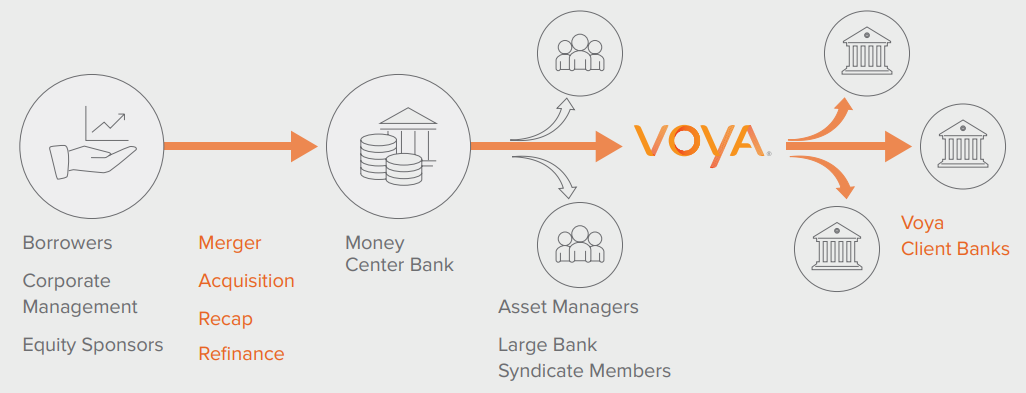

Voya’s Role in the National Scale Senior Loan Market

Insights

FAQ's

What Are Leveraged Loans?

Leveraged loans are extensions of credit to mid and large-sized corporations to finance mergers and acquisitions, recapitalizations, and other growth initiatives. They stand as the most senior debt in the capital structure and are generally secured by a first priority lien on a borrower’s assets. They are floating rate, with a coupon return comprised of a fixed credit spread over SOFR.

Underwriting these loans is typically based on cash flow lending methodologies — the amount of senior secured debt is a function of the level and sustainability of a company’s cash flows. Leveraged loans are privately traded on an established and active secondary market. Most loans are part of the Shared National Credit Program, and the vast majority of those in the Morningstar LSTA US Leveraged Loan Index are rated by at least one of the nationally recognized statistical rating organizations (S&P ratings range from BBB to D, and Moody’s ratings range between Baa1 and D).

Internal Policies and Procedures

The cornerstone of any new banking business venture is to ensure the bank puts in place appropriate policies and operating guidelines to control risk and provide management with appropriate operating, financial, and risk management information. The Voya Leveraged Credit Team will partner directly with your senior bank management in developing a board-approved leveraged loan policy that is appropriate for your bank and adheres to current regulatory leveraged lending guidelines. As your leveraged lending partner, Voya will:

- Work with bank management and a third party loan servicer to establish internal leveraged loan trial balance reporting and accounting interfaces to facilitate seamless management reporting of loan positions and portfolio quality. The Voya Leveraged Credit Team will also work with management in the development of monthly and quarterly portfolio reporting to include risk/return analysis, exposure management, loan loss provision adequacy, and industry concentration limit management;

- Help establish leveraged loan approval and underwriting procedures for your bank that meet regulatory leveraged lending guidelines; and

- Partner with your management team to establish primary and secondary loan trading procedures to ensure appropriate portfolio construction and diversification.

Implementation

The Program allows you to work directly with Voya on an ongoing basis to identify loans that meet your internal policies and regulatory leveraged lending guidelines, as well as exhibit your desired risk/reward profile. Your bank professionals will have access to Voya’s complete underwriting capabilities and the Voya research team:

- Voya works with your bank to build an appropriately sized portfolio of senior loans to match the bank’s risk appetite.

- Voya selects and recommends loans from both the primary and secondary markets to optimize credit quality and risk/return.

- The Voya research team will provide your bank with quarterly monitoring reports, industry insights and economic analyses that will allow you to monitor borrowers within your portfolio; and

- Voya’s trading and settlement of loan acquisition.

Potential Benefits

The Program is a comprehensive corporate lending program that assists regional and community banks build and risk-manage corporate loan portfolios. The Program was designed to be compliant with regulatory leveraged lending guidelines while also addressing the financial and diversification needs of community and regional banks. Potential benefits of the Program include:

- Diversifying your risk with a multi-industry corporate loan portfolio

- Enhancing performance through incremental efficiency, fees and yield

- Accessing the syndicated loan market not typically available to community and regional banks, including both primary syndications and secondary market loan assets

- Serving borrowers who may have operations and employees in your market area

- Building a liquid short term variable rate portfolio that can be sold in a well established liquid secondary market if needed

- Gaining assistance and training from Voya to meet the regulatory requirements of engaging third party providers

- Obtaining training and ongoing or continuous underwriting support to satisfy regulators regarding local risk management controls and processes

- Improving interest rate sensitivity — all loans are floating rate

- Fostering in-house expertise in commercial lending and disciplined risk management

Download Resources

About the Team

The Voya Team is one of the largest2 and most experienced risk managers in the asset class with 30 team members, managing approximately $23.2 billion3 of assets across multiple corporate loan portfolios for a diversified global investor base of institutional and retail clients in over 20 countries.

Michael Moran

Michael Moran

Vice President, Client Advisor

michael.moran@voya.com

(301) 758-4840

Connect on LinkedIn

Connect on LinkedIn

Michael Moran is a vice president and client advisor with the commercial bank advisory group and institutional distribution team at Voya Investment Management. In this role, Michael works with both community and regional banks, to diversify and grow their book of commercial and industrial loans, and with current and prospective institutional clients and consultants across the Southeastern United States region and Canada. He joined the firm following Voya’s acquisition of the substantial majority of Allianz Global Investors U.S. business, where he was a director on the institutional client team and previously worked in the retail distribution group. Prior to that, he worked at Morgan Stanley Wealth Management and Sloane & Walsh, LLP. Michael earned a bachelor’s degree from Boston College and is a CFA® Charterholder. He holds the FINRA Series 7 and Series 63 registrations.

Katie Kreiner

Analyst, Voya Bank Advisory Program

katie.kreiner@voya.com

(480) 477-2469

Connect on LinkedIn

Connect on LinkedIn

Katie Kreiner is an analyst with the commercial bank advisory group team at Voya Investment Management. In this role, Katie assists the team in client activity and communication, ensuring data accuracy, and supporting portfolio implementation and management. Prior to joining Voya, Katie graduated Magna Cum Laude from the University of Arizona with a Bachelor of Science in Finance and Management Information Systems. Katie has also passed the FINRA Securities Industry Essentials (SIE) exam.

Contact Us

1 Source: LCD/Pitchbook, as of 06/30/24.

2 Pension & Investments' Top Managers list published June 2024.

3 As of 06/30/24.

Important Information

This information is proprietary and cannot be reproduced or distributed. Certain information may be received from sources Voya Investment Management (“Voya IM”) considers reliable; Voya IM does not represent that such information is accurate or complete. Certain statements contained herein may constitute “projections,” “forecasts” and other “forward-looking statements” which do not reflect actual results and are based primarily upon applying retroactively a hypothetical set of assumptions to certain historical financial data. Actual results, performance or events may differ materially from those in such statements. Any opinions, projections, forecasts and forward-looking statements presented herein are valid only as of the date of this document and are subject to change. Nothing contained herein should be construed as (i) an offer to buy any security or (ii) a recommendation as to the advisability of investing in, purchasing or selling any security. Voya IM assumes no obligation to update any forward-looking information.

Risk is inherent in all investing. The following are the principal risks associated with investing in the Voya Senior Loan Strategy. This is not, and is not intended to be, a description of all risks of investing in the Strategy.

Credit Risk: The Strategy invests a substantial portion of its assets in below investment grade senior bank loans and other below investment grade assets.

Interest Rate Risk: The yield on senior loans is directly affected by changes in market interest rates.

Leverage Risk: The Strategy may borrow money for investment purposes. Borrowing increases both investment opportunity and investment risk.

Limited secondary market for loans: Because of the limited secondary market for loans, a portfolio invested under the Strategy may be limited in its ability to sell loans in its portfolio in a timely fashion and/or at a favorable price.

Demand for loans: An increase in demand for loans may adversely affect the rate of interest payable on new loans acquired by a portfolio invested under the Strategy, and it may also increase the price of loans in the secondary market. A decrease in the demand for loans may adversely affect the price of loans in a portfolio invested under the Strategy, which could cause such portfolio’s value to decline.

Past performance does not guarantee future results.

Not FDIC Insured | May Lose Value | No Bank Guarantee

For financial professional use only. Not for inspection by, distribution or quotation to, the general public.