The horrific violence that has erupted between Israel and Hamas is likely to reverberate across the Middle East and the world for years to come.

As we mourn the tragic loss of life, we also have a duty to make objective assessments about possible effects on the economy and financial markets.

A key question is whether the conflict can be contained between Israel and Hamas (and potentially Hezbollah to the north), or if Iran will be drawn into direct conflict, spurring broader international involvement. Many nations have deep motivations to avoid such an escalation but the risk cannot be ignored.

Here are a few thoughts on markets in each scenario.

Containment

Markets are cautiously watching and waiting. In the days since the attacks, the major stock indexes have trended generally higher, perhaps expecting that heightened geopolitical risk may tilt the Federal Reserve away from raising rates again this year. Gold has rallied in a flight to safety, while bond yields have retreated. Oil prices rose initially but have since settled. The U.S. dollar cemented its safe haven status, strengthening over the past week.

Further volatility (and more defensive posturing) is likely. The market’s muted response thus far seems to reflect a generalized anxiety about what’s coming next. As the situation unfolds, we expect periods of heightened volatility in global equities and a rotation out of riskier asset classes (including certain emerging markets) and sectors (tech) toward industries such as defense.

Stock and bond movements diverge. Prior to the events, stocks and bonds had been generally rising and falling together, driven by the extreme focus on the negative impact that sustained inflation, a higher-for-longer fed funds rate, and higher borrowing costs have on profit margins. Although it’s a small data set, pricing since the attacks has been influenced more by risk appetite, leading bonds to move in the opposite direction of stocks.1 We believe long-duration Treasury yields are forming a new top-of-range level, and the uncertainty brought by this conflict will incrementally add to the resistance of yields to rise further.

Escalation

Sustained higher energy prices could induce a global recession. Should the conflict spread, we think energy markets could be the most impacted—the question is to what degree. Despite echoes of the current situation to the 1970s, today’s circumstances differ in several important ways. Recent acceptance of Israel among some Arab nations marks a noticeable improvement in relations, and statements by Hamas suggest that one objective of the attack was to derail recent diplomatic momentum between Israel and Saudi Arabia.

That said, widespread conflict could cut off a significant supply of oil. Roughly 20% of the world’s daily crude oil production passes through the Strait of Hormuz.2 Any blockade of this important transportation lane—which connects the Persian Gulf with the Gulf of Oman and the Arabian Sea—could spike prices. According to the IMF, a 10% increase in oil prices would lower global output by 0.2% the following year and increase global headline inflation by 0.4%.3

However, the U.S. economy has room to absorb higher energy prices. If oil were to rise 15–20% from current levels, it would still be below the $130/bbl high from early 2022. Although this would drive headline inflation and hurt consumers, it takes time for higher oil prices to pass through to core inflation—its price is less volatile than the overall market. The U.S. is now less reliant on energy, and it’s also less energy intensive: Each unit of GDP requires 70% less oil than it did in the 1970s.4 Moreover, the Fed would be unlikely to react to a sudden spike in energy prices, as such moves are often viewed as transitory. Meanwhile, increased recession risk could cause the Fed to take a less restrictive stance sooner than anticipated.

Big picture

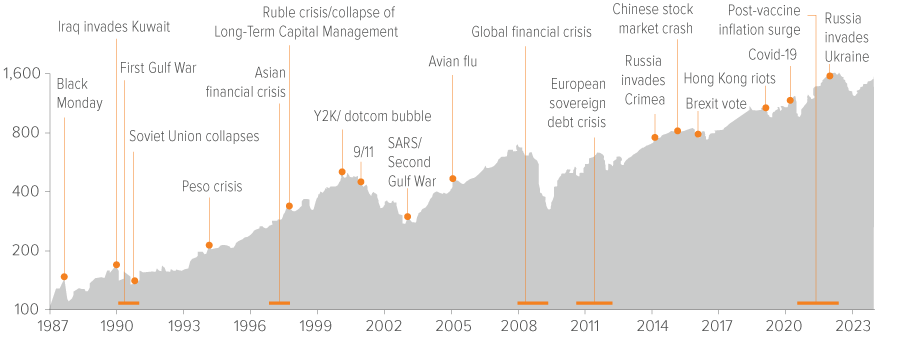

We are carefully monitoring events and revisiting our investment theses to determine the potential impacts of higher energy prices, lower consumer spending and/or negative economic growth on portfolio companies as a result of these developments. For investors, it is important to remember at times like these that asset prices are not systematically correlated to geopolitical risks, especially over time. While uncertainty creates volatility, the path of global equities over the decades has remained up and to the right (Exhibit 1). Meanwhile, we believe bonds currently offer compelling value, paying higher yields for less risk than at any point since the aftermath of the 2008–09 financial crisis.5

As of 10/13/23. Source: MSCI, Voya IM. MSCI World total return, indexed to 100 at 01/01/87.