Weekly Notables

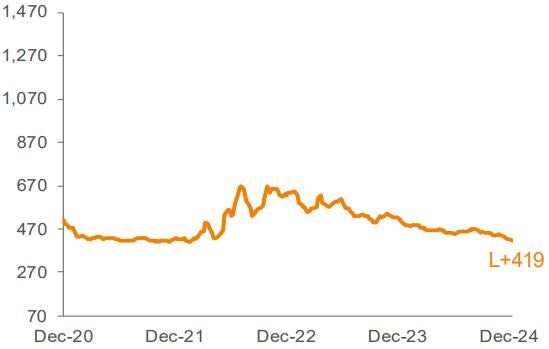

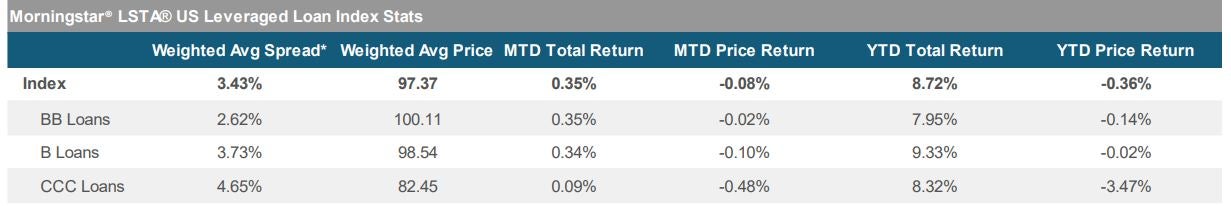

The Fed implemented its final rate cut of 2024, lowering rates by 25 bp, bringing the total reduction for the year to 100 bp. The median FOMC dot plot projections signaled less cuts in 2025 than previously expected, which led to a pick-up in volatility across broader financial markets. With this backdrop, the loan market’s performance was on the lighter side this week, as the Morningstar® LSTA® US Leveraged Loan Index (Index) returned -0.03% for the seven-day period ended December 19. However, YTD returns remain strong, with a gain of 8.72%. Looking at secondary prices, the average Index bid price slipped by 4 bp, finishing the week at 97.37.

The primary market was active this week, with arrangers wrapping up a few deals before the year ends. Overall, December set a new record for repricings , reaching a total of $153 billion, surpassing the previous high of $115 billion set in May of this year. Looking at the forward calendar, net of the anticipated $18.5 billion of repayments not associated with the forward pipeline, the amount of repayments now outstrip new supply by about $6.4 billion, versus net supply of $4.9 billion in the prior week.

Trading levels in the secondary market were weaker across all credit quality. In terms of performance, Double-Bs outperformed this week, posting a positive return of 0.01%. On the other hand, Single-Bs and CCCs were in the red at -0.02% and -0.27%, respectively.

CLO formation remained on track, finishing the year strong. There were seven deals priced during the week, pushing the YTD tally to over $197 billion. According to Morningstar, retail funds experienced an inflow of $560 million for the week ended December 18.

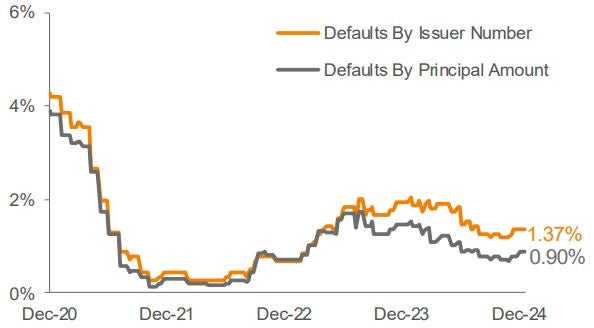

There were no defaults in the Index during the week.

Source: Pitchbook Data, Inc./LCD, Morningstar ® LSTA ® Leveraged Loan Index. Additional footnotes and disclosures on back page. Past performance is no guarantee of future results. Investors cannot invest directly in the Index. *The Index’s average nominal spread calculation includes the benefit of base rate floors (where applicable).