Weekly Notables

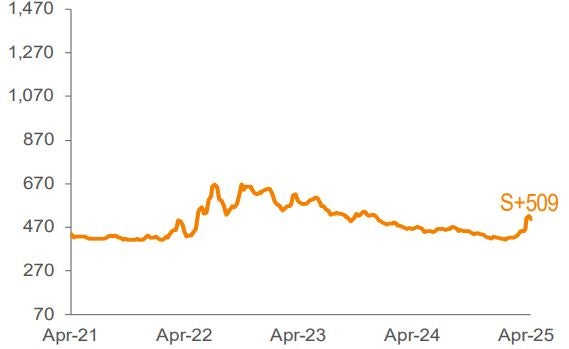

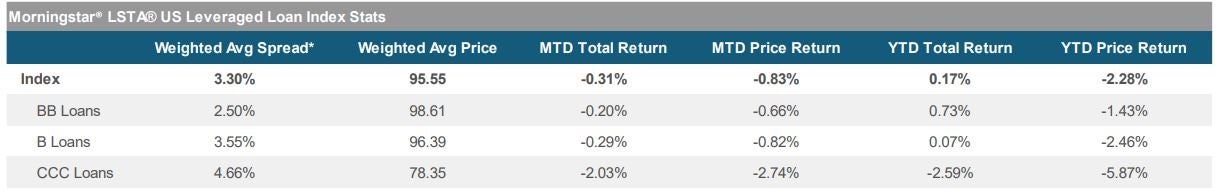

The loan market showed positive momentum this week. The Morningstar® LSTA® US Leveraged Loan Index (Index) returned 0.62% for the seven-day period ended April 24. The average Index bid price gained 44 bp, closing out the week at 95.55.

With a firmer backdrop, the primary activity picked up this week. M&A activity accounted for the majority of supply, totaling $2.5 billion. Looking at the forward calendar, net of the anticipated $19 billion of repayments not associated with the forward pipeline, the amount of repayments now outstrip new supply by about $2.2 billion, versus net supply of $2.5 billion in the prior weekly estimate.

Trading levels in the secondary market moved higher during the week. In terms of performance, all rating categories posted positive returns this week, recovering from losses recorded earlier this month. Single-Bs were in the lead with a 0.70% return, while Double-Bs and CCCs returned 0.56% and 0.13%, respectively.

CLO managers priced five deals this week, pushing the YTD volume to $60.7 billion. On the other hand, retail loan funds saw an outflow of $1 billion for the week ended April 23, bringing the YTD net outflows to $5.5 billion. The majority of this week’s outflows came from ETFs, which saw $615 million in withdrawals, while mutual funds experienced outflows of $386 million. On a YTD basis, ETFs made up 65% of total outflows, while mutual funds accounted for 34%.

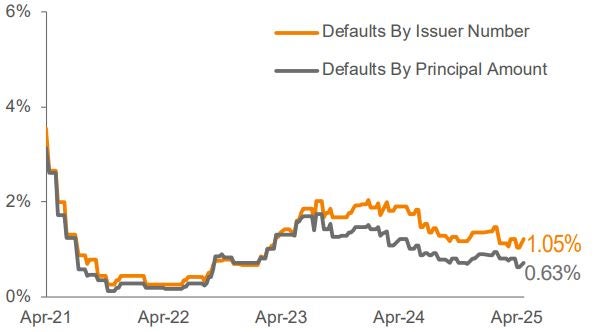

There were two defaults in the Index this week (Ascend Performance Materials and HealthChannels).

Source: Pitchbook Data, Inc./LCD, Morningstar ® LSTA ® Leveraged Loan Index. Additional footnotes and disclosures on back page. Past performance is no guarantee of future results. Investors cannot invest directly in the Index. *The Index’s average nominal spread calculation includes the benefit of base rate floors (where applicable).