Weekly Notables

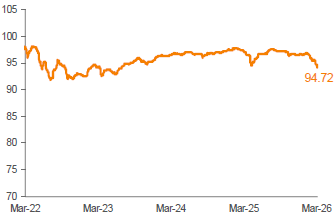

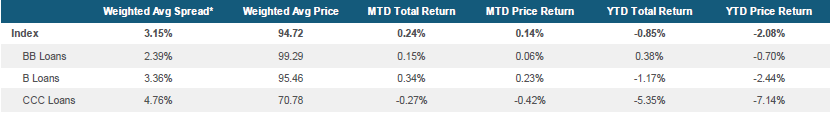

Risk assets experienced heightened volatility this week as escalating tensions in the Middle East fueled a sharp rise in oil prices. The conflict has intensified concerns about potential disruptions to global energy supply, particularly through the Strait of Hormuz, which is a critical maritime chokepoint that facilitates a significant share of the world’s oil and LNG shipments. The surge in energy prices has complicated the inflation outlook and scaled back expectations for near-term rate cuts. In response, Treasury yields moved higher this week, while credit spreads broadly widened across fixed income markets. The weighted average bid price for the Morningstar LSTA US Leveraged Loan Index (Index) ended the week at 94.72, roughly in line with last week’s levels. Although the secondary market traded down initially alongside other risk assets, the market recovered all the losses later in the week as CLO buyers stepped in and provided bid support. As a result, the Index posted a gain of 0.13% for the seven-day period ending March 5, driven primarily by coupon income.

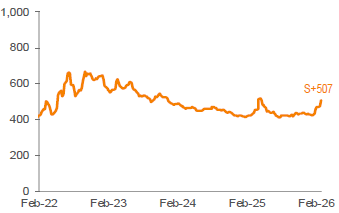

The primary market remained subdued for a second consecutive week as a more uncertain macro backdrop constrained new-issue activity. After a robust start to the year, issuance has slowed notably, with February volumes falling well short of January’s strong pace, and only a handful of transactions have launched so far in March. In response to the softer technicals, new-issue spreads moved wider and issuers have increasingly offered concessions to get deals across the finish line. The subdued tone is also reflected in the forward calendar, as repayments continue to outstrip new supply.

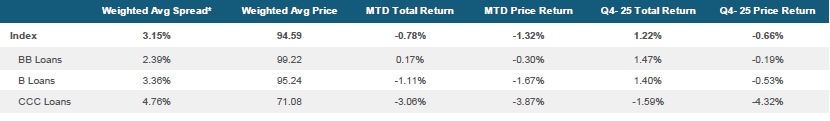

While overall secondary levels were largely unchanged, bifurcation remained a prominent theme in the secondary market. Dispersion and differentiation among issuer quality cohorts and sectoral themes are becoming more evident in secondary trading levels and collateral price stratification. Bid levels for BBs firmed, Single-Bs were largely flat on the week, while CCCs extended their decline. CCC-rated loans have lost over 5% to start the year, as investors remain cautious within this space.

The CLO market remained busy, as managers priced ten new deals this week, bringing YTD issuance to $30.9 billion. Meanwhile, US retail loan funds recorded a $1.22 billion outflow for the week ending March 4, according to Morningstar, extending the recent streak of outflows to six weeks.

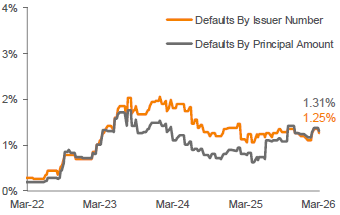

There was one payment default in the Index this week (Cumulus Media).

Source: Pitchbook Data, Inc./LCD, Morningstar LSTA US Leveraged Loan Index. Additional footnotes and disclosures on back page. Past performance is no guarantee of future results. Investors cannot invest directly in the Index. *The Index’s average nominal spread calculation includes the benefit of base rate floors (where applicable).

Monthly Recap: February 2026

AI disruption fears and a broader risk-off tone further weighed on sentiment in the loan market, leading to a negative 0.78% return for the Index in February, which was the worst monthly performance in more than three years for the asset class. The AI concerns deepened in software and permeated into other parts of the market, such as Insurance, IT Services and Professional Services. The relatively sizable Software sector led most of the Index’s losses, as the sector fell by 4.17%, bringing its YTD return to -7.02%. The weighted average Index bid price decreased to 94.59 by month end, 205 bps below the starting point for the year, and is now at its lowest level since last April. The overarching risk-off sentiment resulted in a pronounced bifurcation across ratings, with BBs gaining for a second consecutive month, while Bs and CCCs faced steep declines.

Outside of any AI-linked names, the technicals for the broader loan market remained relatively constructive in February, driven by ongoing bid support from ramping CLOs. However, new loan issuance was understandably constrained given the more pronounced secondary market weakness, as arrangers launched a total of $36.1 billion of transactions (including repricings), which was a nine-month low for the asset class. After an extremely strong pace of repricings last month at $111 billion, repricing activity fell to just $11 billion in February due to the weak secondary backdrop, with the percentage of loans trading above par now at 18% compared to 58% at the end of 2025. Net of repricing activity, institutional loan issuance also decreased sharply, with just $25.2 billion issued during the month. The volume was fairly split between refinancings and M&A activity. On the investor demand front, CLO issuance picked up meaningfully after a relatively slow start to the year in January. Managers priced a robust $19.5 billion across 41 deals for the month. As expected during volatile periods, the less sticky retail investor base redeemed at an elevated clip in February, as Morningstar reported a net outflow of $4.5 billion for the month. Given the retail channel’s limited ownership of the loan market (projected to be at around 7-8%), this increased outflow activity did not have a material impact on the overall technical backdrop.

Default activity modestly increased in February as there was one payment default and two liability-management exercise (LME) restructurings. As a result, the trailing 12-month payment default rate moved up to 1.38% (from 1.29% in January). However, LCD’s dual-rate tracker that includes LMEs was largely unchanged at 3.54%, as a few defaults rolled off the trailing tally. For 2026, we expect defaults to remain modest overall and continue to be primarily driven by LME transactions. Since LMEs often don’t yield positive outcomes in sustaining long-term operational performance for a company, as evidenced by a significant number of borrowers eventually return to a traditional BK filing, we continue to expect a protracted but (importantly) modest default cycle going forward.

Source: Pitchbook Data, Inc./LCD, Morningstar LSTA Leveraged Loan Index. Additional footnotes and disclosures on back page. Past performance is no guarantee of future results. Investors cannot invest directly in the Index. *The Index’s average nominal spread calculation includes the benefit of base rate floors (where applicable).