Much of the securitized credit market displays improving fundamentals and is benefiting from the current encouraging economic growth—but expect some turbulence as overly optimistic Fed prognostications are brought down to earth.

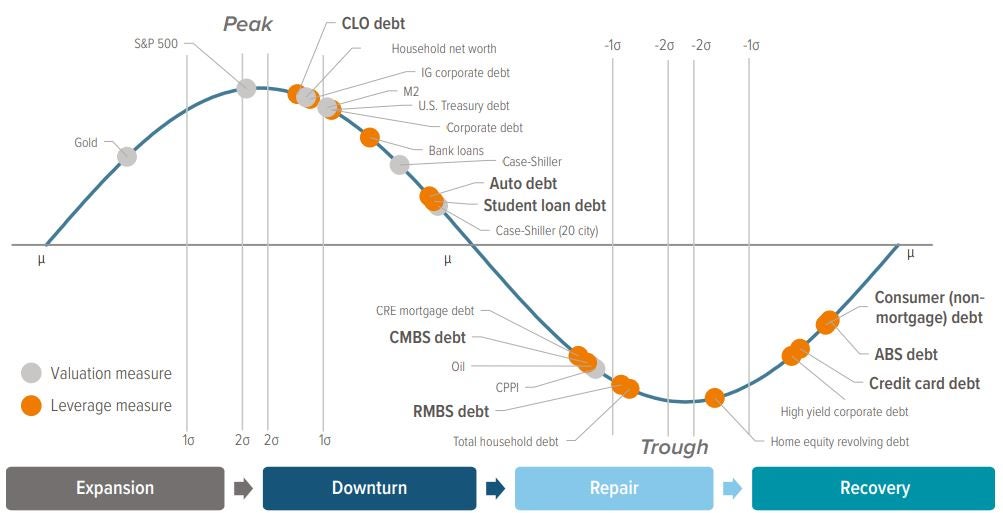

With three out of four sectors in recovery or early expansion mode, and with the market underpinned by friendlier monetary policy and positive economic growth, securitized credit is exiting its recent winter of discontent with “room to run.” At the same time, the preferred portion of the opportunity set has changed significantly between 2023 and 2024. CLOs—last year’s star bet—are likely to face difficulties this year, while CMBS—which might as well have been radioactive last year—are now seeing a constructive reframing of risk following 4Q’s rate rally and given the market’s expectation for Fed rate cuts.

Macro environment

- While rate cuts will broadly benefit much of the securitized market (excepting CLOs), we expect volatility to reemerge as market expectations for five cuts in 2024 are brought down to earth.

- Positive economic growth will broadly benefit holders of credit risk—and specifically investors in securitized credit sectors, especially underlying borrowers in ABS, CMBS and RMBS.

- Equity and fixed income returns will likely decouple, returning to a traditional negative correlation in 2024, as disinflation continues and focus on economic growth returns.

- 2023 securitized issuance ranged from strong in ABS to significantly down in CMBS and RMBS. We expect a modest pickup in mortgage-backed issuance, fostered by lower rates. ABS should be full steam ahead, and CLO issuance is likely to be “sneaky strong.”

- Geopolitical risks always seem to lurk on the horizon, but they remain disconnected from securitized credit market dynamics.

Securitized credit sectors

- CMBS activity and issuance volumes remain depressed, but the sector is early cycle, emerging from its trough, and very cheap; anticipated rate cuts are significantly reframing opportunities in the sector.

- Higher-quality consumer-oriented ABS offers the steadiest source of total returns, with a strong labor market, easing rates and moderating inflation providing a tailwind for most consumers.

- Non-agency RMBS continues to deliver, thanks to the “golden handcuffs” of sub-5% mortgages, strong labor markets and historically high homeowner equity.

- After a head-turning streak of outperformance, CLOs are vulnerable to falling rates and slower (but still positive) economic growth, with the sector facing valuation challenges as an unprecedented number of deals navigate their post-reinvestment windows.

As of 02/07/24. Source: Voya IM.