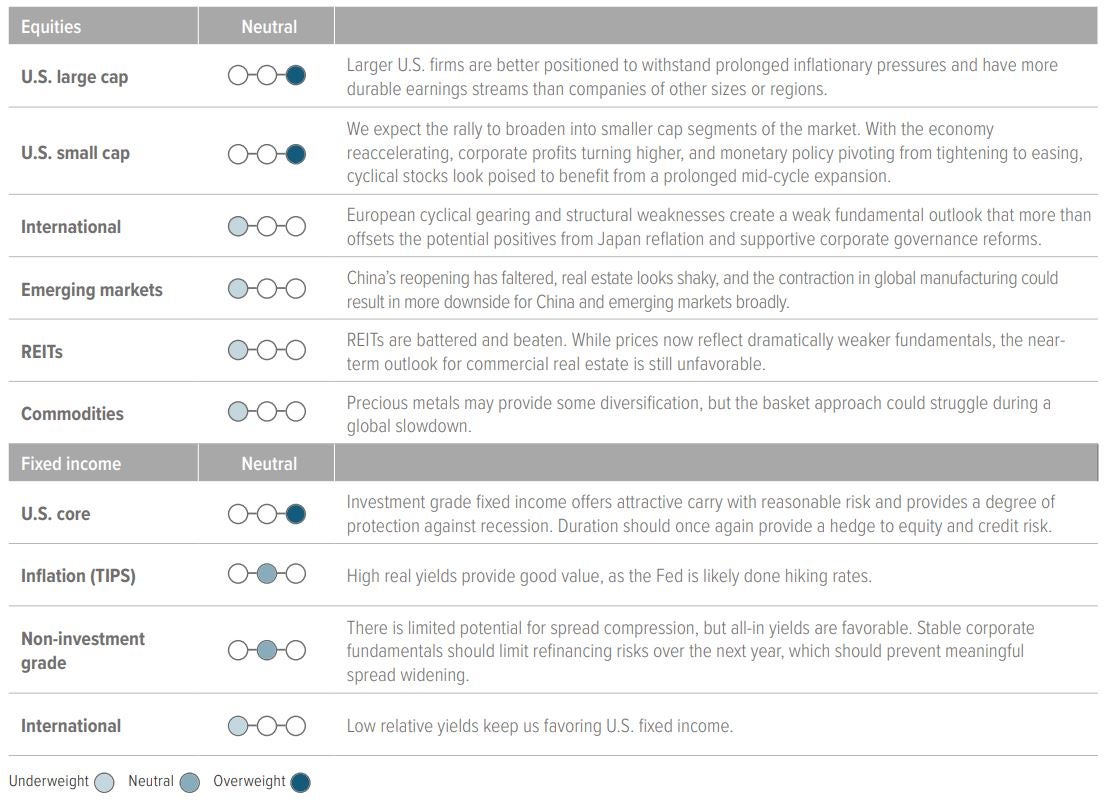

The current market backdrop presents opportunities for allocators to benefit from divergences in earnings growth, geopolitical risk and monetary policy. However, in this uneven macro environment, we emphasize balance in our multi-asset portfolios, favoring U.S. large cap equities and high-quality fixed income.

Quick take

Softening labor market doesn’t indicate recession

While consumer spending remains stable, the U.S. labor market is showing signs of softening. This may reduce demand-driven inflation, but we don’t think it signals an impending recession.

Support for U.S. equities persists

Favorable economic conditions and strong earnings momentum could underpin strength in U.S. equities and a broadening rally into more cyclical, smaller cap names.

Balanced portfolio positioning

The current market backdrop presents opportunities for allocators to benefit from divergences in earnings growth, geopolitical risk and monetary policy. However, in this uneven macro environment, we emphasize balance in our multi-asset portfolios, favoring U.S. large cap equities and high-quality fixed income.

Tactical indicators

Economic growth (solid but slowing)

1Q24 U.S. real GDP grew an annualized rate of 1.6% from a quarter ago, down from an average of 3.5% in the prior three quarters. Consumer spending rose 2.5%, while government spending rose only 1.2% (down from 4.6% growth in the prior quarter) as gains from infrastructure spending faded. We believe below-trend growth is needed to pull inflation down to the Fed’s 2% target, and we see signs that it’s headed in the right direction.

Fundamentals (neutral)

S&P 500 4Q23 earnings grew 10.1% year over year,1 with 8 of the 11 sectors increasing and 76% of companies beating expectations. We think U.S. corporate earnings can continue growing in the high single digits as technology stocks maintain positive momentum and other sectors begin to catch up, extending the expansion.

Valuations (neutral)

In aggregate, large cap U.S. equity forward earnings multiples are above their historical average, but strong corporate cash flows support this. Non-U.S. equities are cheap, but weaker fundamentals warrant discounts. Sentiment (neutral) After coming off all-time highs at the end of March, U.S. equity markets have moved from overbought to neutral on several widely followed sentiment indicators.

Investment outlook

U.S. economy: Resilience amidst a disinflationary pause and labor market softening

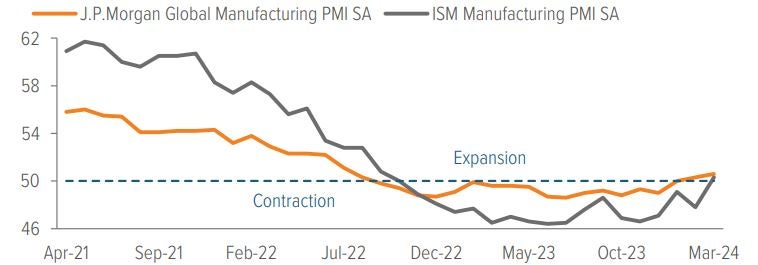

The U.S. economy remains resilient; real GDP expanded 2.5% in 2023 due to payroll and productivity gains, which more than offset the effects of Fed tightening. We think economic growth will moderate closer to trend but stay strong in 2024. U.S. and global manufacturing activity is picking up (Exhibit 1).

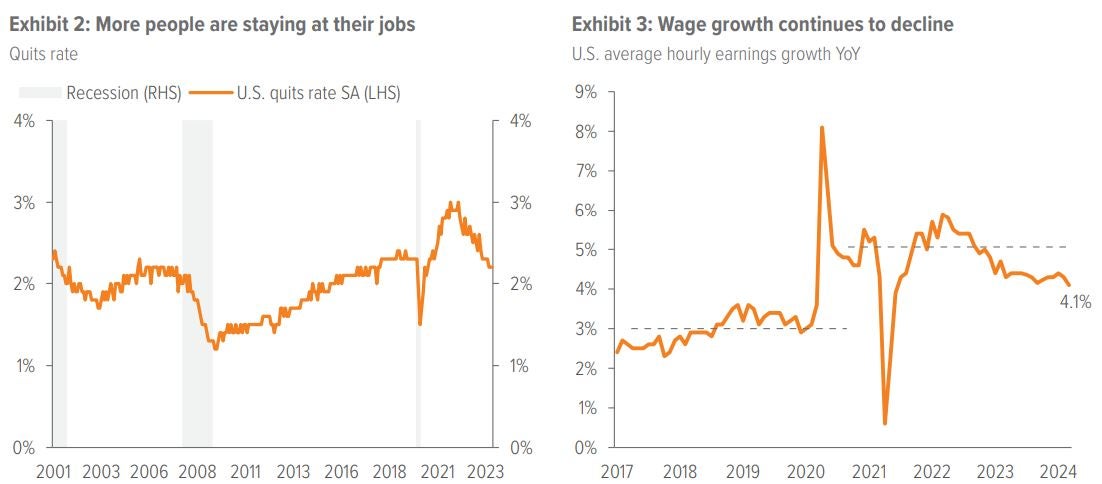

Consumer spending momentum appears to be stable. Household net worth has risen by an astounding $39.3 trillion (equivalent to 140% of GDP) since the start of the pandemic. Also, the U.S. labor market continues to be solid overall but is showing modest signs of softening. Firms are hiring fewer workers, the unemployment rate has been trending higher, and payroll growth is still solid but slowing. Quits have declined to below pre-pandemic levels (Exhibit 2), and average hourly earnings growth is gently moderating (Exhibit 3). The 4.1% annual growth rate is still too strong for the Fed’s liking, but we think wage growth can decline to 3% by year-end, which could help lessen stickier demand-driven inflation.

As of 03/31/24. Source: Bloomberg, Bureau of Labor Statistics, Voya IM.

Portfolio positioning

We remain balanced in our view on global stocks versus bonds. U.S. large cap equities and high-quality fixed income are our favorite asset classes.

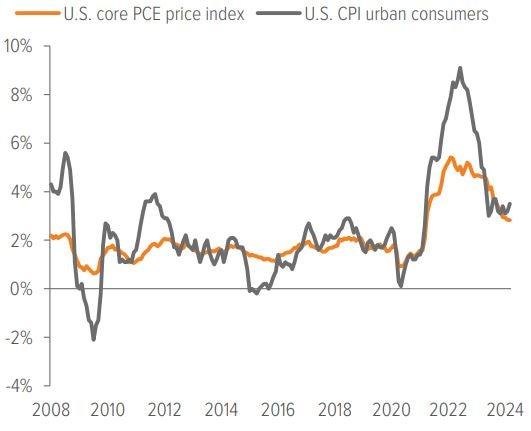

Although inflation has fallen to more manageable levels—core PCE inflation declined for 15 consecutive months to 2.8% in March—concerns about overheating persist, especially in the housing-heavy CPI data (Exhibit 4). We believe that further disinflation is more probable and that fears of resurging inflation are overblown.

As of 03/31/24. Source: Bloomberg.

To achieve inflation near the Fed’s 2% target, we think downshifting growth and further easing of the labor market are necessary. This doesn’t mean the economy needs to weaken significantly, but rates may stay higher for longer than some participants expect. Fed funds futures had previously priced in seven rate cuts this year, but the market is now pricing in only two 25-basis-point cuts. This expectation is below the Fed’s projections; at its March meeting, it maintained expectations for three cuts this year despite lifting its outlook for inflation and growth.

In our opinion, the number of cuts is less important than the rationale and economic data, which will ultimately dictate policy. The Fed’s broader view of the economy and its longer-term guidance for the path of interest rates should persist if the inflation and employment data cooperate.

The U.S. has the most dynamic, innovative and resilient economy in the world. It is showing pockets of acceleration in the housing and manufacturing sectors, with healthy consumers, higher corporate profits and shifting monetary policy. Although concerns about inflation and overconcentration in the equity markets persist, the macro backdrop is overwhelmingly positive and underpins our belief that the risk asset rally may broaden out, justifying our continued home country bias.

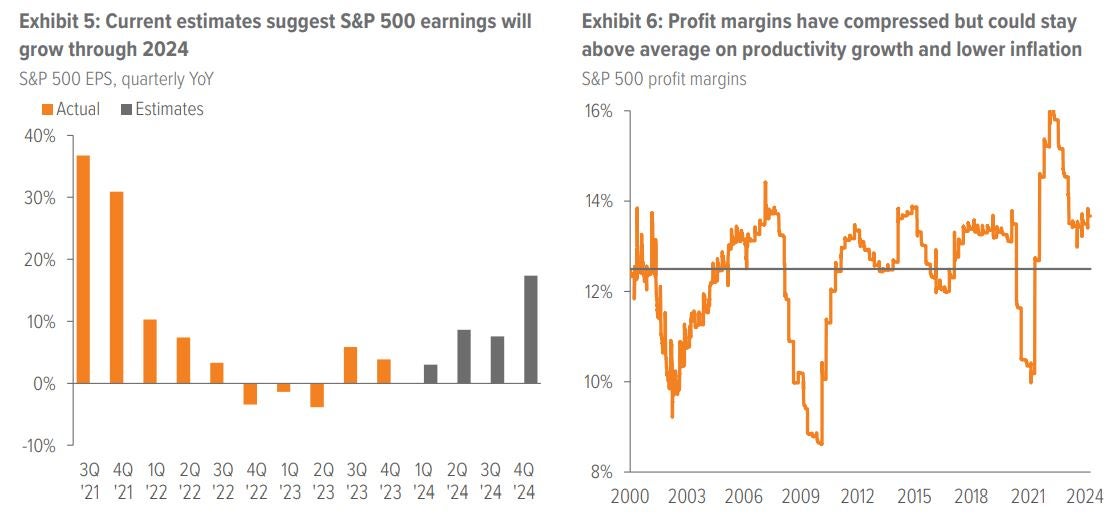

U.S. equities: Expect the rally to broaden on favorable economic conditions and strong earnings momentum

In addition to the economic environment, U.S. stocks are supported by strong earnings momentum, which could continue throughout the year. S&P 500 1Q24 year-over-year (YoY) earnings growth is estimated to be 2.7%,2 which would mark the third consecutive positive quarter. We think earnings will continue to grow faster than consensus expectations suggest (Exhibit 5), as the ongoing resilience of consumer spending should lead to healthy sales volumes, and durable margins are underpinned by robust corporate pricing power and meticulous cost cutting (Exhibit 6).

Valuation is an important factor to consider in long-term investing. While U.S. large cap earnings multiples continue to expand beyond long-term averages (Exhibit 7), growth and quality of earnings justify a premium. Using the price/ earnings to growth (PEG) ratio, mega-cap tech stocks are cheaper than the broader S&P 500. We recognize that breakneck growth rates can’t last forever, but if U.S. tech firms turn into entrenched global artificial intelligence (AI) monopolies, increasing global market capitalization share is justifiable.

As of 04/30/24. Source: Bloomberg.

However, a broadening rally—as mid-cap and smaller cap segments of the market take the lead—is more likely for the rest of the year. With the buoyant economy, rising corporate profits and pivoting monetary policy, cyclical stocks look poised to benefit from a prolonged expansion. To take position for these developments and reduce tech sector concentration risk, we have modestly increased our allocation to U.S. mid-cap equities and reduced our overweight to U.S. large cap equities.

Overall, the economic soft landing and looser financial conditions, coupled with anticipated rate cuts, create a favorable environment for U.S. stocks. Although stock prices have appreciated significantly and a near-term pullback looks possible, the accumulation of cash in money market funds points to the potential for a further rally once the Fed reduces rates.

Europe: Mixed macro conditions and disappointing earnings

In contrast to the U.S., Europe’s 4Q23 earnings season disappointed, as profits declined 11% from the year earlier. The macroeconomic situation remains mixed, characterized by ongoing conflicts and a prolonged manufacturing downturn in Germany, Europe’s largest economy (Exhibit 8). Additionally, large European companies face greater exposure to a structurally weak China through imported products such as solar panels, electric vehicles and related items. These factors reinforce our continued underweight in the region.

As of 04/30/24. Source: Bloomberg.

Japan: BOJ signals confidence and concern as stocks rise

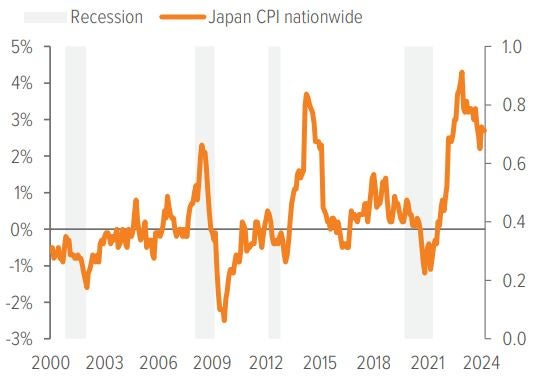

The Bank of Japan (BOJ) raised interest rates for the first time in 17 years and ended yield curve control, a program of extraordinarily loose monetary policy aimed at combating sluggish economic growth and deflationary threats. This move, coupled with much-needed inflation, strong earnings growth and ongoing corporate reforms, suggests that Japanese equities may continue to rally, even though the Nikkei 225 Index is currently near its all-time high.

In the years following the global financial crisis (and, more recently, the pandemic), most countries returned to normal monetary policies, while Japanese rates remained below zero to battle structural deflation (Exhibit 9). This move could signal a sustained upswing in nominal GDP. A more cynical view is that this action was a desperate attempt to strengthen the yen, which has weakened against the U.S. dollar (USD) to levels last seen in 1990. We think it’s a combination of both! However, a stronger yen could have positive implications for Japanese stocks and be a much-needed benefit to China.

As of 04/30/24. Source: Bloomberg.

China: Challenges persist, but the bottom may be in

China’s slowing economic growth, geopolitical risks, governance uncertainties, and financial system burdened with bad real estate debt have contributed to investor skepticism and caused a deep decline in stocks. One of the Chinese Communist Party’s goals is to replace real estate with industry and technology as the main drivers of growth. Japan, which has benefited from the weak yen, is a key competitor in these areas. If the yen strengthens against the renminbi (RMB), China’s outlook could improve. Regardless, the bigger issue is the ongoing deleveraging from the property crisis (Exhibit 10), which needs to be worked out over time and/or with assistance from the government. A revitalization of consumer spending and confidence is also necessary.

As of 04/30/24. Source: Bloomberg.

While China faces significant challenges, not all is lost. Its auto industry is booming, and it is leading advancements in turbines, solar panels, power plants and other industrial technologies. In addition, although the U.S. has begun decoupling supply chains—which is hampering manufacturing and exports—the process will take a long time. In the interim, prominent global firms are unlikely to abandon the largest consumer market in the world. Nevertheless, the outlook for Chinese stocks remains highly uncertain (despite interesting valuations), bolstering our preference for U.S. equities.

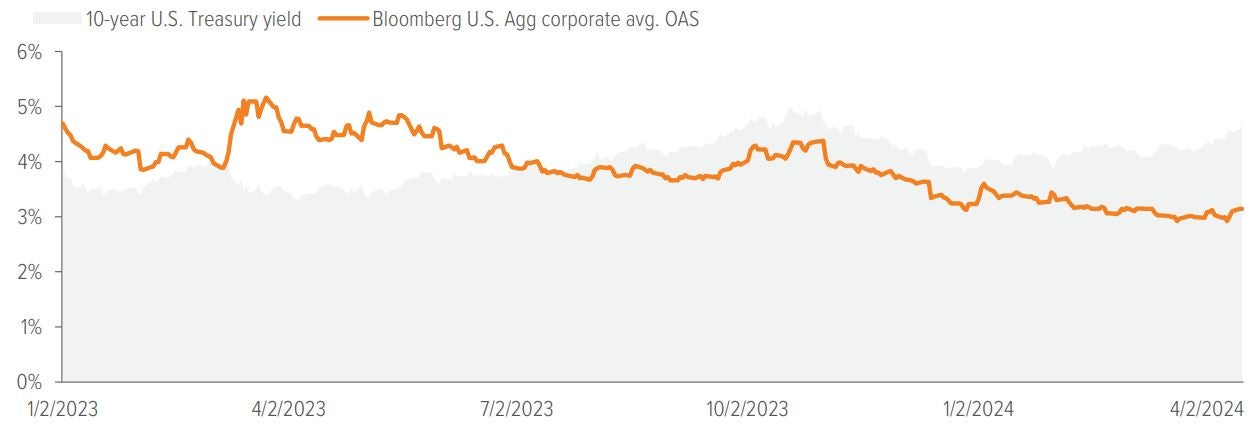

Bonds: Strong fundamentals should contain high-quality spreads, allowing investors to keep more carry

In 1Q24, bond yields drifted higher on the back of stronger-than-expected economic growth and hotter-than-forecasted inflation. While higher longer-end rates make duration more attractive and provide a good entry point for fixed income investors, we are maintaining our neutral duration posture and think an up-in-quality overweight to credit remains the best risk-adjusted position. Investment grade credit is supported by the U.S. macroeconomic backdrop, where strong earnings suggest solid corporate fundamentals. Even if the current tight spreads widen later this year, we think the move will be limited and carry will keep total returns positive (Exhibit 11).

As of 04/15/24. Source: Bloomberg. Left axis shows the 10-year Treasury yield. Right axis shows the investment grade spread, as represented by the Bloomberg U.S. Aggregate Bond Index corporate average option-adjusted spread.

A note about risk Certain of the statements contained herein are statements of future expectations and other forward-looking statements that are based on management’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. All investments are subject to market risks as well as issuer, credit, prepayment, extension, and other risks. The value of an investment is not guaranteed and will fluctuate. Actual results, performance or events may differ materially from those in such statements due to, without limitation, (1) general economic conditions, (2) performance of financial markets, (3) interest rate levels, (4) increasing levels of loan defaults, (5) changes in laws and regulations and (6) changes in the policies of governments and/or regulatory authorities. |