Key Takeaways

Regulatory restraint: The administration’s push to reduce the cost and complexity of regulatory compliance should deliver a lift to U.S. businesses (especially financial firms) while paving the way for broader adoption of crypto assets.

Bots and bytes: Companies’ deployment of AI is picking up steam, creating resilient growth opportunities at a time of economic uncertainty.

Europe rearms: A surge in defense spending in the face of growing Russia tensions and NATO uncertainty is creating opportunities for European defense and cybersecurity companies.

After a volatile start to the year, we see opportunities as markets focus on President Trump’s deregulatory agenda, tech’s unrelenting rise, and Europe’s defense surge.

After a bumpy start to 2025, fueled largely by policy uncertainty under the Trump 2.0 administration, markets seem to have settled. The CBOE Volatility Index (VIX) is trading near its 10-year average. The S&P 500 rebounded from a 20% peak-to-trough drawdown to log a healthy gain year to date. And the U.S. 10-year Treasury yield has settled squarely within its 12-month trading range at around 4.4%.

It’s a welcome reprieve, but there are concerns it could be temporary. Policy uncertainty has eased from prior peaks but remains elevated. Similarly, recession concerns have moderated from earlier this year, but risks of renewed inflation and slower growth persist, particularly as trade negotiations conclude and higher tariff rates take hold. At the same time, the geopolitical backdrop remains precarious, with tensions simmering in the Middle East and Ukraine.

As of 07/13/25. Source: Bloomberg.

Yet there are reasons for cautious optimism in the balance of the year. The economy could see a near-term boost from tax cuts in Trump’s mega-bill, and business sentiment could improve if the president’s deregulatory agenda materializes. And though we’re not holding our breath, clarity on trade policy could boost business investment and influence the pace of Fed policy action.

Against this backdrop, we highlight three investment themes for the second half that are positioned to benefit from policy changes and ongoing innovation, while remaining resilient to potential headwinds.

1 Regulatory restraint.

Trump’s deregulatory agenda provides a boost to financials

U.S. financial firms stand to benefit from the Trump administration’s plans to reduce the regulatory burden on banks. Since taking office, Trump has reduced funding, cut staffing, and reshaped leadership across key financial regulatory agencies, appointing allies to senior roles at the Treasury Department and Federal Reserve.

In early June, Michelle Bowman was confirmed as the Federal Reserve’s Vice Chair for Supervision. She is setting a pragmatic tone to bank oversight, advocating for a revisiting of onerous banking regulations put in place in the wake of the global financial crisis.

One such proposal is to adjust the supplementary leverage ratio, which requires large banks to maintain a certain percentage of their capital against all bank assets, regardless of risk. If implemented, this change could enhance bank balance sheet flexibility and potentially increase demand for Treasuries, which would support lower yields and improve Treasury market liquidity.

Other expected changes include easing capital requirements under Basel III Endgame, relaxing M&A rules, and loosening consumer protection rules. A reduced regulatory burden on banks should lower operating costs, improve deal flow, and lead to improved profitability for the banking sector.

Regulatory clarity catalyzes crypto assets

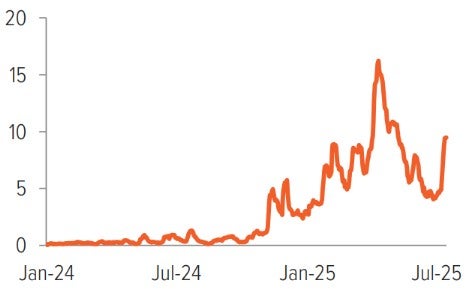

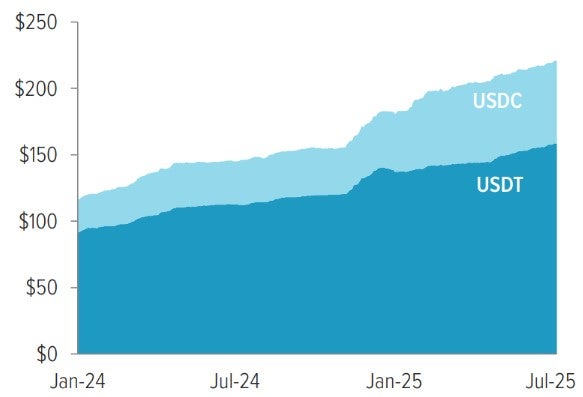

Outside of traditional banking, breakthroughs in cryptocurrency regulation are catalyzing renewed interest and investment in the digital assets space.

Recently, the Senate passed the GENIUS Act, which establishes industry standards and consumer protection guardrails for stablecoins, a type of cryptocurrency that is price-linked to fiat currencies. The bill requires stablecoin issuers to maintain reserves backing their tokens, helping to protect consumers from liquidity risks during periods of market stress. The two most prominent stablecoins, USDC and USDT, are issued by Circle and Tether, respectively. Regulatory clarity is helping legitimize stablecoins for mainstream use cases such as cross-border payments and remittances. It may also entice more companies, such as banks and e-commerce providers, to issue new stablecoins.

While the crypto market is in early innings in the U.S., a foundation for a digital asset ecosystem is taking shape. Optimism surrounding the space has contributed to soaring share prices for key players such as Circle and Coinbase, and we see a range of companies benefiting from favorable cryptocurrency regulation, including crypto miners, digital payments and trading platforms, and blockchain solutions providers.

As of 07/07/25. Source: Bloomberg.

2 Bots and bytes.

Secular tech themes offer resilient growth amid lingering economic and policy uncertainty

Amid lingering economic uncertainty, there are attractive opportunities in secular tech themes, such as AI and cybersecurity, which are relatively insulated from macroeconomic headwinds. Some beneficiaries of AI acceleration—notably chipmakers—have greater exposure to tariffs and trade restrictions. However, companies that are enabling downstream applications and services offer a way to diversify exposure beyond infrastructure plays.

AI adoption is picking up steam across industries as companies seek to boost operational efficiency, innovation, and customer experience. The next phase of AI applications introduces AI-powered agents to collaborate with humans on decision-making and task completion. So-called “agentic AI” systems go beyond automation by demonstrating reasoning, planning, and the ability to adapt to changing circumstances. The integration of AI agents is leading to transformation across industries, such as customer relationship management, cybersecurity, financial services, and health care.

As of 06/30/25. Source: Census Bureau, Business Trends and Outlook Survey. Based on a rotating panel of 1.2 million non-farm businesses surveyed biweekly.

A new paradigm of safety is taking shape in the digital world

Cybersecurity firms are also benefiting from the AI trend. On one hand, malicious actors are abusing AI to launch larger, more complex attacks. On the other, cybersecurity companies are using the technology to enhance their ability to detect and respond to cyber threats. There is optimism around the potential for generative AI–which can create new content based on existing data–to automate security operations. Given the heightened risk, precarious geopolitical environment, and security skills shortage, cybersecurity budgets have been relatively resilient despite macro volatility.

3 Europe rearms.

Geopolitical strife strengthens the case for investments in European defense

In the 80 years since World War II, prolonged peace in Europe has influenced defense spending policies and shaped investor sentiment toward the defense industry. Over that time, defense spending as a percentage of GDP has decreased significantly, from nearly 4% in the 1960s to around 1.5% before Russia’s invasion of Ukraine in 2022. Since the war started, European nations have shifted their stance on the defense industry, focusing on its importance to national security instead of its association with violence, conflict, and human rights abuses.

As of 07/07/25. Source: Bloomberg.

As the war between Russia and Ukraine has escalated and tensions have risen in the Middle East, European countries have significantly ramped up their military spending. According to the Stockholm International Peace Research Institute, total military spending in Europe (including Russia and Ukraine) rose by 17% in 2024 to $693 billion, up by 83% from 2015. More specifically, military expenditure in Central and Western Europe grew by 14% to $472 billion in 2024, rising 59% over the past decade. In Germany alone, military spending increased 28% from 2023 to 2024—up 89% from 2015 levels.

The increased investment in the defense industry has benefited European defense stocks in recent months. At the same time, a number of European asset managers have loosened restrictions on investments in the defense sector, and we see scope for further incorporation of defense stocks in sustainable portfolios going forward.

The outlook for spending remains bright, with NATO leaders agreeing to increase defense spending to 5% of GDP to combat an increasing threat to peace and security from Russia. The new spending target—which breaks down into 3.5% for core defense spending and 1.5% in related investment, including infrastructure and cybersecurity—will potentially unlock trillions of dollars in defense expenditures over the next decade, providing a lasting tailwind to companies in the space.

Bottom line

Though equity returns for 2025 are unlikely to reach the back-to-back 25% heights of the last two years, we believe the second half of the year is shaping up to offer positive results. In an uncertain environment, we see opportunities in safety (cybersecurity and defense), resilient secular growth trends in technology, and financial firms that stand to benefit from a regulatory rethink.

A note about risk: The principal risks are generally those attributable to investing in stocks and related derivative instruments. Holdings are subject to market, issuer, and other risks, and their values may fluctuate. Market risk is the risk that securities or other instruments may decline in value due to factors affecting the securities markets or particular industries. Issuer risk is the risk that the value of a security or instrument may decline for reasons specific to the issuer, such as changes in its financial condition. Foreign investments could be riskier than U.S. investments because of exchange rate, political, economic, liquidity and regulatory risks. Additionally, investments in emerging market countries are riskier than other foreign investments because the political and economic systems in emerging market countries are less stable. Smaller companies may be more susceptible to price swings than larger companies, as they typically have fewer resources and more limited products, and many are dependent on a few key managers.