Key Takeaways

10-year Treasury yields staying high will mean tough refinancing choices for many property owners, but it also means significant opportunity for lenders as transaction volumes return to normal.

Cap rates will likely stay compressed given the significant amount of capital that has been sitting on the sidelines—they are much less volatile than Treasury rates and won’t necessarily spike upwards to follow a higher-for-longer 10-year Treasury yield.

As the market continues to stabilize, lenders are benefiting from valuations being reset in many cases, allowing for better attachment points for loans.

Beyond traditional lending, there is increased market interest in shorter-dated paper and opportunities for rescue finance as maturities loom.

The commercial real estate market’s mantra was “survive to 2025,” but this year is not shaping up to be the low-rate lifeboat property investors hoped for. That presents multiple opportunities for lenders.

Fed cuts haven’t translated into falling mortgage rates

The long-awaited shift in Federal Reserve monetary policy came in September of 2024 with a 50 bp cut to the benchmark overnight rate, followed by successive 25 bp cuts in November and December. Yet how has the market reacted? Despite the -100 bp move by the Fed, the key market-driven 10-year Treasury yield actually rose 90 bp after the cutting cycle began—from 3.68% on 09/17/24 to 4.58% at the close of January.

As such, the much-discussed 2s10s yield curve both disinverted and rose as interest rates began to normalize following the Fed’s decisions. It’s not exactly what commercial real estate (CRE) market investors had hoped for, which was for the 10-year rate to fall (or at least remain flat), allowing for lower borrowing rates and the return of positive leverage to investment transactions.

With consensus expectations for (a) inflation persisting in the 2.5-3.0% range and (b) growing federal budget deficits, it is quite possible that 10-year rates will remain in the 4.5% range for all of 2025. While that’s not ideal, rates that are broadly stable (or falling) give investors the ability to set market-clearing prices, leading to opportunities for lenders with patient capital and the right sourcing capabilities.

Interest rates and cap rates: It’s the spread that matters

While it is appealing to assume cap rates will move in lockstep with underlying Treasury rates, this is rarely the case. Instead, cap rate movements are far less dramatic— which means cap rate spreads compress and decompress to absorb the higher volatility of interest rates and bond markets.

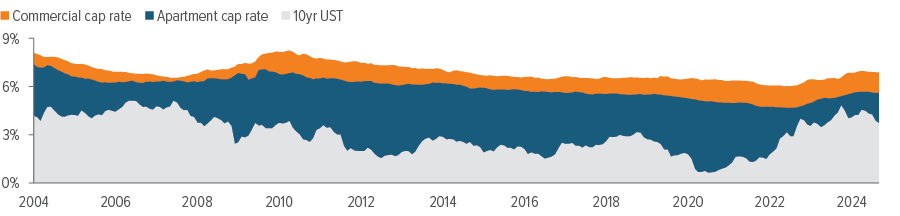

The cap rate spread is the difference between the market cap rate and the 10-year Treasury rate, and it generally reflects the risk/return spread for CRE assets. Over the past 20 years, cap rate spreads averaged 396 bp for all commercial property types and 297 bp for apartment assets. These spreads widened as the 10-year Treasury fell to near 0.50% in 2020, maxing out at 580 bp and 464 bp, respectively, as real estate investors refused to chase yields in the midst of the pandemic (Exhibit 1).

As such, this current era of normalization is most likely going to experience cap rate spread compression as the primary response to the current interest rate dynamics, rather than rising cap rates. Compounding this, there remains significant capital looking for CRE investments, which could limit cap rate increases.

As of 01/10/25. Source: MSCI Real Capital Analytics, Federal Reserve.

Political uncertainty may keep rate expectations high

If the U.S. weren’t in the middle of a regime change, the next move for cap rates and spreads would be fairly predictable. Long-term interest rate expectations are still downward facing, so the 10-year Treasury would eventually calm down. Cap rates would likely lag the move, slowly coming down over the course of the year while also trending back towards long-term average spreads.

However, with a new administration in Washington and the expiration of the 2017 Tax Cuts and Jobs Act, there is likely to be major legislation on taxation and fiscal spending that could directly inflate (or, in theory, deflate) long-term federal deficits—and thus impact inflation, investor expectations, business sector and market psychology, and even Fed rate policy decisions.

As such, any Federal action perceived to be inflationary or budget-busting could move interest rate expectations upward. Unless Treasury rates move substantially over 5%, however, cap rates are unlikely to rise due to the current supply/demand imbalance in commercial real estate—and the lack of attractive alternatives for capital sitting on the sidelines.

Alternatively, policies that are seen as driving economic growth while containing or lowering spending could move the 10-year Treasury yield substantially lower. But unless such policies are enacted, expect higher rates as investors hedge risk exposures.

In any case, as new supply and construction starts reduce dramatically in the second half of 2025, we see existing assets gaining market power. Thus, fundamental demand expectations are likely to dominate market direction this year.

Transaction volumes likely to trend higher

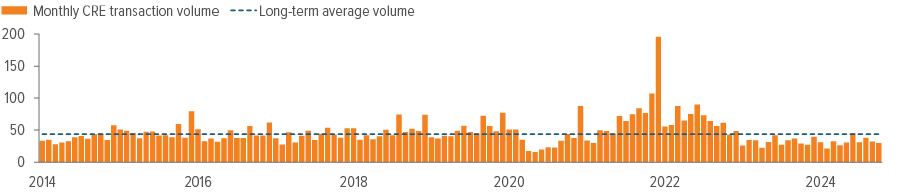

Transaction volume in CRE has fallen significantly since the Fed began its tightening cycle in mid-2022. Overall volume in the first three quarters of 2024 was flat, year over year, as investors waited on the Fed in the (ultimately vain) hope that mortgage rates would fall (Exhibit 2).

On top of stubbornly high mortgage rates, we now also face a cutting cycle that is more anemic than the CRE market had hoped for. The Fed has signaled that there will be fewer rate cuts in 2025 than previously expected, with a likelihood of only two additional 25 bp cuts. Given this, what’s next for the CRE market?

There are a few factors at work. First, the economy is broadly in good shape, with last year’s predictions of a “soft landing” coming to pass. The Bureau of Economic Analysis reported 4.3% GDP growth in the fourth quarter of 2024, and most economic indicators remain healthy. Despite September’s yield curve disinversion being a typical recession indicator, we saw the Conference Board Leading Economic Index rise in November for the first time since February 2022.

Second, real estate markets have historically been very successful with 10-year Treasuries in the 4% range (and higher). So rates staying at current levels should not be a scary prospect, unless one had highly optimistic expectations for lower rates (such as 10-year rates in the low threes) and made investment or lending decisions accordingly.

Even with current rates higher than some market participants had hoped, we expect transaction volumes to increase in 2025 as pent-up demand to both buy and sell is released. Similarly, additional commercial loan originations should be expected, at least relative to 2023 and 2024’s low base. This year’s much-discussed $1.5 trillion maturity wall will also need to be reconciled, unless lenders and borrowers again decide to extend deadlines—which is a real possibility given current rates.1

This will put interesting pressure on observed commercial pricing from market trades and refinance transactions. Pricing declines continued through the third quarter of 2024. With 10-year rates moving higher than expected, it is difficult to foresee much overall commercial property price appreciation in 2025.

As of 01/10/25. Source: MSCI Real Capital Analytics.

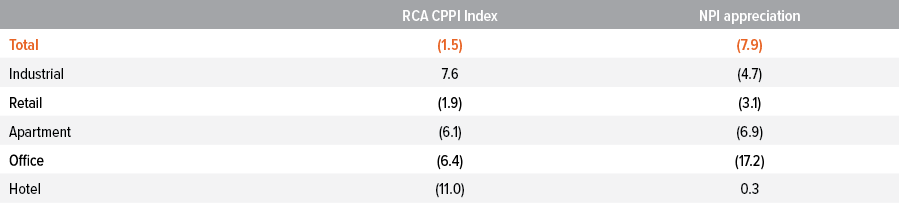

In fact, transaction-based price indexes (such as the RCA CPPI) may show greater declines as more distressed assets trade while stabilized and trophy assets remain off the market (Exhibit 3).

On a micro level, while many asset prices have already reset over the past two years, we expect pricing variance to continue as higher transaction and lending volumes create new valuations. In other words, successful CRE investing will—more than ever—require careful bottom-up analysis and knowledge of local markets, as some sectors, markets and assets will show price appreciation while others show declines.

As of 10/31/24. Source: MSCI Real Capital Analytics Commercial Property Price Index (CPPI), National Council of Real Estate Investment Fiduciaries Property Index (NPI).

Exhibit 3: Commercial property price movement in 2024

For lenders with a patient approach and proper underwriting, many valuations have already been adjusted downward (outside of some distressed assets), which means that lending at the new, lower basis should help offset broader market uncertainty. After a 10+ year upcycle in CRE, it feels much better lending at (for example) 65% of value on a property that has already come down 20-30% from its peak.

The process of investors adjusting to this new normal is also presenting some unusual opportunities for lenders. Alongside a stabilizing market with more plentiful core loan origination volumes, we are also seeing a heightened interest in shorter-dated paper, as well as opportunities for rescue finance with preferred equity kickers as investors work to right-size their capital structures ahead of sales—especially in multi-family.

The market has been operating with a “wait and see” mentality since the Fed began aggressive tightening in mid-2022, with the expectation that this would be the “return to normal” year—there was even a literal mantra of “survive to 2025” among many market participants.

Now 2025 is here, and the “normal” doesn’t quite look like what many investors expected. For some, this will be a painful adjustment. For others, it will be a great opportunity. But, overall, we believe the market can thrive in this new normal.

A note about risk

Investments in commercial mortgages involve significant risks, which include certain consequences as a result of, among other factors, borrower defaults, fluctuations in interest rates, declines in real estate values, declines in local rental or occupancy rates, changing conditions in the mortgage market, and other exogenous economic variables. All security transactions involve substantial risk of loss. The strategy will invest in illiquid securities and derivatives, may employ a variety of investment techniques (such as using leverage), and will concentrate primarily in commercial mortgage sectors, each of which involves special investment and risk considerations.