The story of the fixed income markets over the past six months is broadly one of spreads tightening across the board as funds flow back into bonds. Yet there’s one standout: agency mortgage-backed securities (MBS), which have historically tracked within a 150-200 basis point spread to the 10-year U.S. Treasury. Some may argue that they are one of the safer credit assets around: default risk is minimal since they are backed by government-sponsored entities (GSEs) like Fannie Mae and Freddie Mac, and prepayment speeds are at historic lows thanks to the sharp differential between today’s 7% mortgage rates and the 3-4% rates of only a few years ago. So why are MBS spreads currently at a 20-year high?

As of 04/15/24. Source: Federal Reserve.

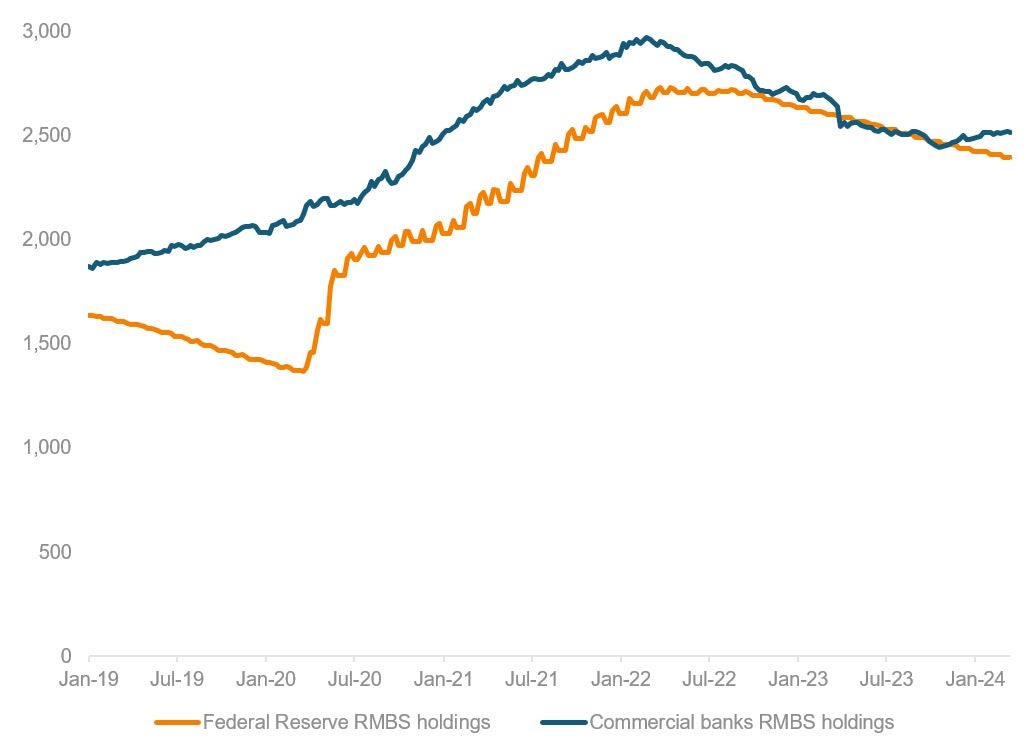

The short answer is that MBS’ two most dependable consumers in recent years—commercial banks and the Federal Reserve—have sharply reduced their appetites.

The Federal Reserve occasionally buys MBS to support the U.S. economy during times of unusual turmoil, first wading into the market in 2009-2010 in the aftermath of the Global Financial Crisis. The Fed again started large-scale buying of MBS at the onset of the pandemic. At its peak in August 2022, the Fed had $2.72 trillion of agency mortgage-backed securities on its balance sheet, only $80 billion less than the MBS holdings of all commercial banks in the U.S. combined.

As of 04/15/24. Source: Federal Reserve.

The Fed stopped buying MBS in September 2022, and since then has been reducing its holdings by letting them passively pay down without reinvestment. The Fed could move towards actively selling MBS; some voting members of the FOMC have spoken in favor of shrinking their holdings of mortgages to zero.

As for banks, even though the FDIC-led sell-off of assets from March 2023’s bankruptcies was fully digested by October 2023, it caused banks to be much more cautious with new lending. They have nonperforming assets on their balance sheet that they need to shake out, at the same time as Basel 3’s proposed compliance date looms—along with its increased capital adequacy requirements.

Overall holdings of MBS by commercial banks are down 7% from where they were immediately before the bankruptcy crises of last March. Given that these MBS are prepaying at 3-4% per year, this seems to indicate that banks are largely not replacing them as they pay off.

Without demand from the recent primary sponsors of the MBS market—banks, the Federal Reserve, and in prior years the GSEs’ portfolios—spreads in mortgage assets have become historically cheap compared to corporate credit and the rest of fixed income. As it seems likely that MBS will eventually return to its historic trading range, this creates an opportunity-rich environment for investors both in MBS and in mortgage-related asset derived from MBS.

Maverick Lin contributed to this article.