Factor investing should take into account industry differences and adapt as markets change.

Executive summary

Factor investing is a type of investment approach that involves systematically targeting specific drivers of return, among and across asset classes. Factors generally fall into two main categories: macroeconomic factors and style factors. For example, equity factor investing might target desirable characteristics such as “value” and “price momentum,” which academic research has shown to have delivered return premiums historically. Moreover, factor investing offers the potential to tailor portfolio strategies to improve outcomes, reduce volatility and enhance diversification.

These are the principles that we consider key to effective factor investing:

Use factors to invest in stocks, not stocks to invest in factors

- Investors invest in stocks, not factors.

- Even staunch factor enthusiasts end up buying stakes in individual companies.

Successful factor investing requires multi-dimensional analyses

- What matters to companies’ prospects and market value varies greatly by the nature of their businesses.

- Quantitative investors can benefit from the insights of fundamental analysts and machine learning tools.

Generically applying factors across different industries is a recipe for suboptimal outcomes

- The utility of factors as future performance indicators varies across different sectors.

- For example, book value matters more among industrials, where manufacturing plants and equipment may put a floor under the share price.

- Book value does not fully reflect the value of intellectual property, however, and is therefore less useful for technology companies, where research and development are more important.

- Effective factor investing employs a broad view that takes into account the differences across industries.

Markets and industries change over time — factor investing should too

- The “new economy” is increasingly knowledge based, with wide “moats” protecting profitability margins and market shares due to networking effects and the dominance of global brands.

- To remain effective, factor investing strategies must adapt over time to keep up with the changes in businesses, markets and industries.

- Similarly, the data and techniques used for effective factor investing are evolving from linear models using traditional financial data to nonlinear machine learning with features based on new data sources.

The next frontier for factor-based investing is to devise strategies with the potential to deliver on investment outcomes and investor needs, rather than just aiming to outperform a benchmark. For example, strategies with a high dividend payout but low volatility may be particularly attractive for investors in the decumulation phase of retirement planning, i.e., through retirement, when they need both income and growth but cannot take on the full risk of a sudden equity market downturn. Ultimately, what matters is not the labeling of a strategy but whether it contributes to meeting clients’ investment objectives in a risk-managed and cost-effective manner.

Which came first? The stock or the factor?

Voya uses factors to invest in stocks, rather than using stocks to invest in factors.

In the past, investors would own a diversified portfolio of stocks after carefully analyzing their fundamentals. These days, many profess to invest in “factors.”

Factors are characteristics of stocks that help explain volatility and dispersion in their returns. Share prices of stocks with similar factor exposures often move in tandem, which is particularly useful for risk management purposes. Importantly, exposure to certain factors historically has delivered a return premium over the market. Efficient-market adherents have explained this as a reward demanded by rational investors for taking on additional downside risk during bear markets. Other researchers have attributed this return anomaly to a combination of behavioral biases among investors, agency problems in the asset management industry and market-structural limits on arbitrage.1

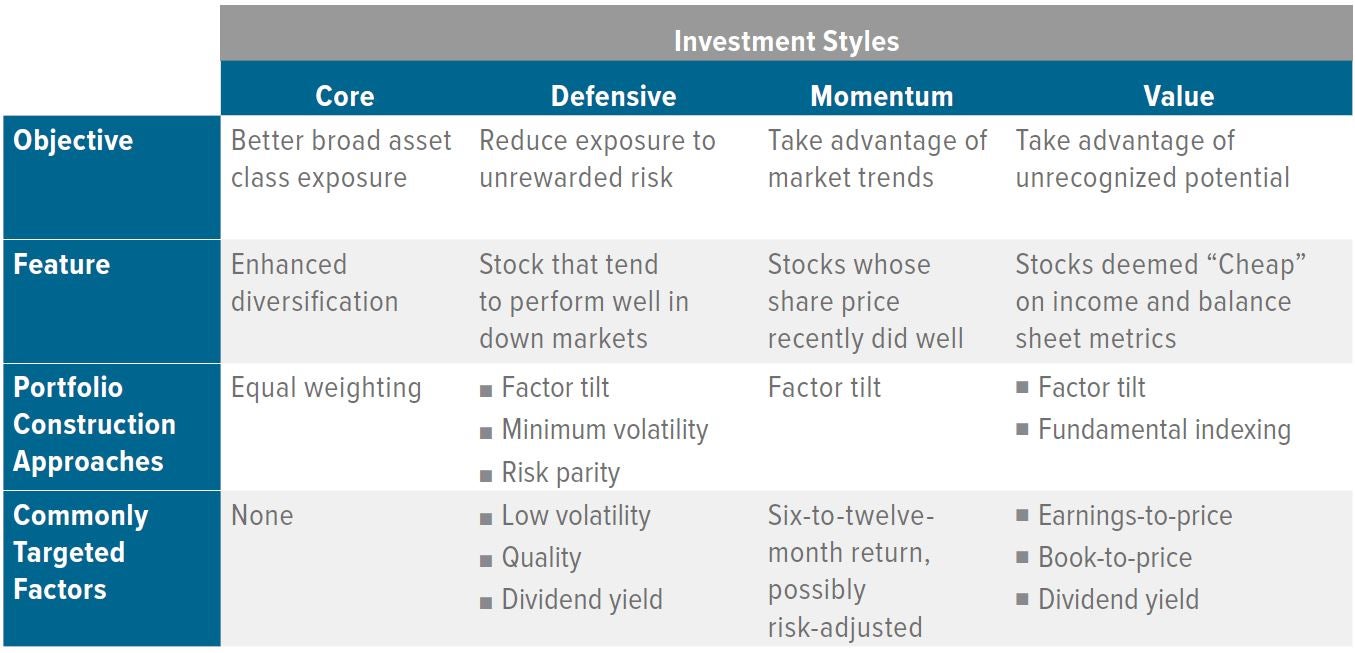

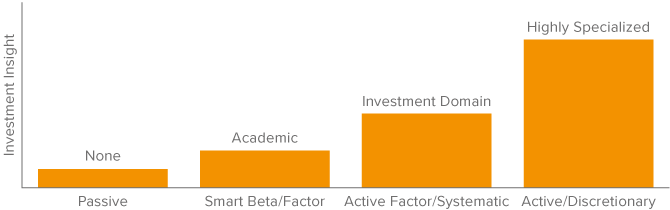

“Factor investing” systematically targets stocks with desirable factor exposures, seeking to earn these expected long-term return premiums. The primary investment styles include defensive, momentum and value — in contrast with “core” investing, which features no style bias (Exhibit 1). The appeal of such systematic strategies includes their relative simplicity, the ability to evaluate their historical efficacy, their scalability across different segments of the equity market, the ease of customizing to investor needs and wants, and the relatively low cost of implementation.

Source: Classification adapted from “A Taxonomy of Beta Based on Investment Outcomes,” De Boer, S., LaBella, M. and Reifsteck, S., The Journal of Index Investing, Summer 2016. “Quality” refers to profitable companies with stable earnings and low financial leverage that distribute profits to shareholders and invest conservatively.

Ultimately, factor strategies should help clients meet their investment objectives.

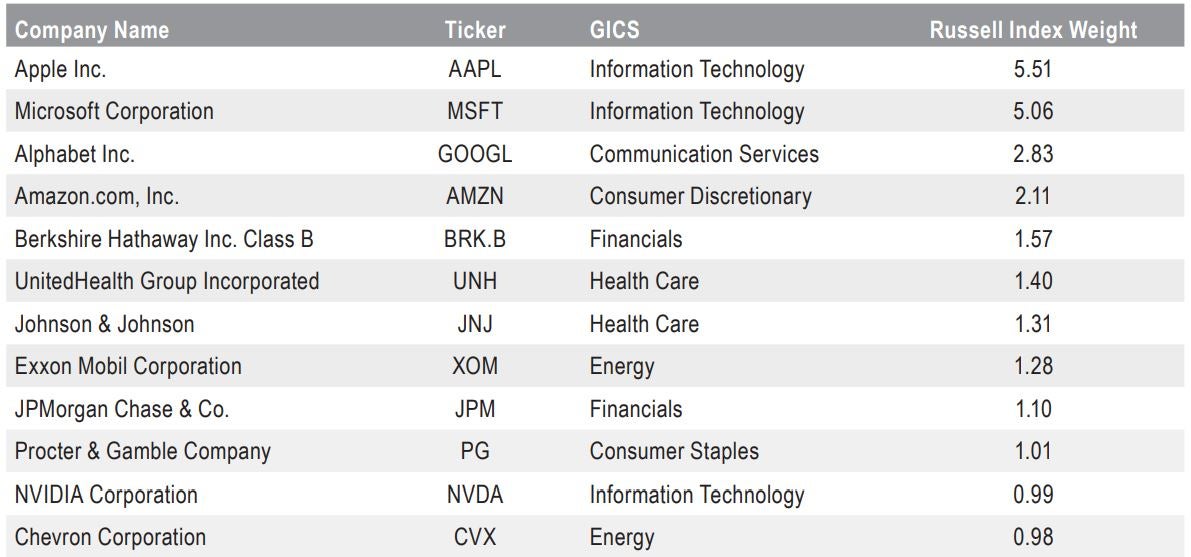

Exhibit 1 makes clear that factor investing is merely a subset of the so-called “smart beta strategies,” which are characterized by simple, transparent and rules-based approaches for obtaining equity market exposure that aim to outperform capitalization-weighted indexes. Smart beta also includes strategies aimed at enhanced diversification, addressing the concentration risk of capitalization-weighted indexes (Exhibit 2). For example, equal-weighted index strategies seek to mitigate concentration risk by reducing exposure to the largest capitalization stocks in an index.2

As of 12/31/22. Source: FactSet; Russell 1000 Index top 12 as percent of total index value.

The categories in Exhibit 1 are not mutually exclusive; for example, investing in stocks with a high dividend yield can be considered a “defensive value strategy.” This sort of cross-pollination can be useful in building hybrid approaches such as low-volatility equity strategies with an income objective. Moreover, constraints on active exposures and tracking error in portfolio construction can keep performance of a factor-based portfolio closely tracking the core equity market, which remains an important investment consideration for asset allocators.

Perceived advantages of factor investing spur widespread use

Factor strategies can be designed to address needs such as income, growth and capital preservation.

Factor investing is sometimes seen as a lower-cost alternative to active management. For example, an influential study of Norway’s Government Pension Fund showed that its poor return during the global financial crisis, as well as its preceding outperformance, was fully explained by factor exposures, and therefore did not merit the fees paid to its broad line up of active managers.3

In addition, the inherent transparency of factor investing lends itself well to exchange-traded funds, which offer the benefit of daily liquidity. A wide range of smart beta strategies thus has been offered as ETFs, whose widespread acceptance has led to the strategies’ exponential growth in recent years.

While factor investing may be on the rise, its use predates strategies marketed as such, and even the academic literature on the subject. Following the principles of Graham and Dodd, active investors have used “valuation” considerations at least as far back as the 1930s, long before professors Fama and French included book-to-price in their influential three-factor model of stock returns in 1992. In the 1970s and 1980s, Barr Rosenberg created the Barra factor risk models. Market participants picked up on the alpha-delivering potential of those models long before academics accepted them. Similarly, famed trader Jesse Livermore rode price trends nearly a century before Jegadeesh and Titman documented their efficacy in 1993.

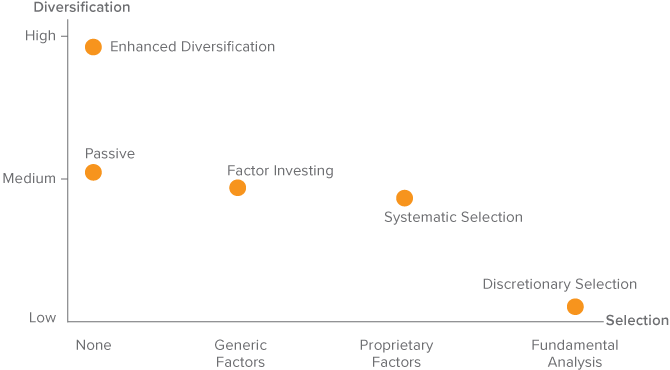

Taken in this historical context, factor investing can be seen as a systematizing of insights developed by fundamental investors. It is therefore not surprising that systematic factor strategies may emulate the performance of overly diversified discretionary investors. Arguably, the potential added value of fundamental stock pickers in a diversified, multi-asset portfolio is to take concentrated positions in stocks for which they have strong conviction of a high, idiosyncratic payoff. In contrast, factor investors diversify to mitigate stock-specific risks, for which they have no expectation of being rewarded (Exhibit 3).

Source: Voya Investment Management.

Limitations of factor investing

The efficacy of factors changes over time — factor strategies need to change, too.

Investors should be mindful, however, that factors are crude metrics. Importantly, they are not directly investable — even staunch factor enthusiasts end up buying stakes in individual companies. What matters to those companies’ prospects and market value very much varies by the nature of their businesses; with regard to such issues, quantitative analysts can learn something from fundamental investors.

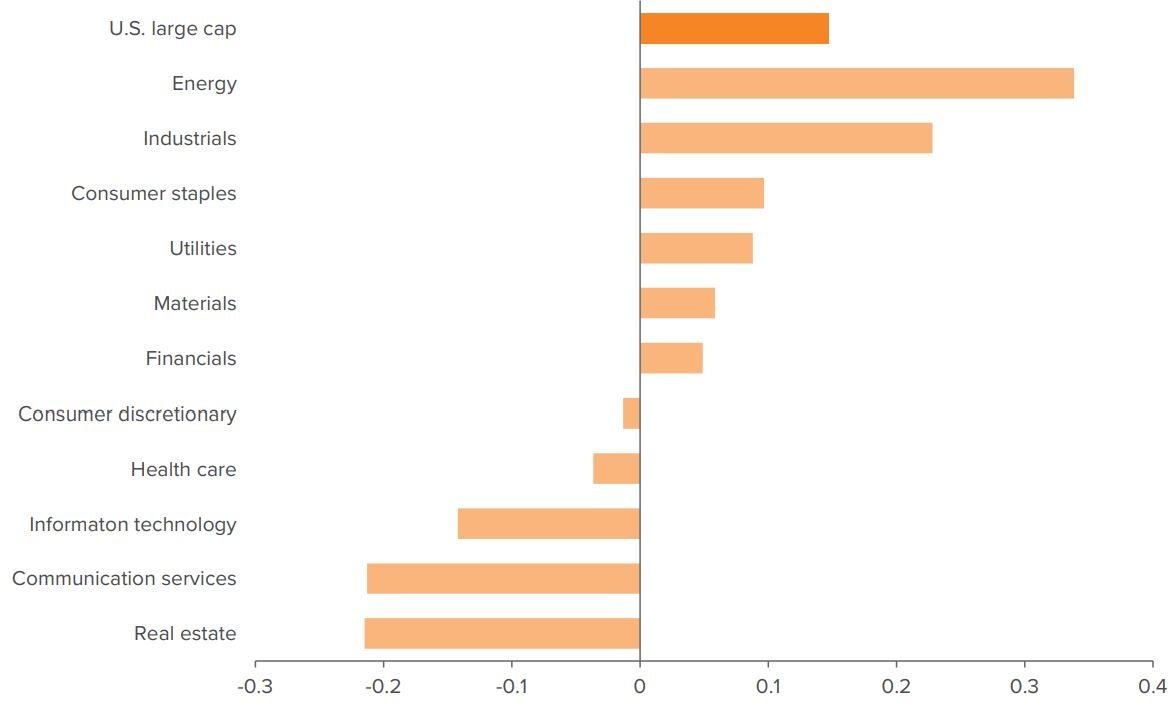

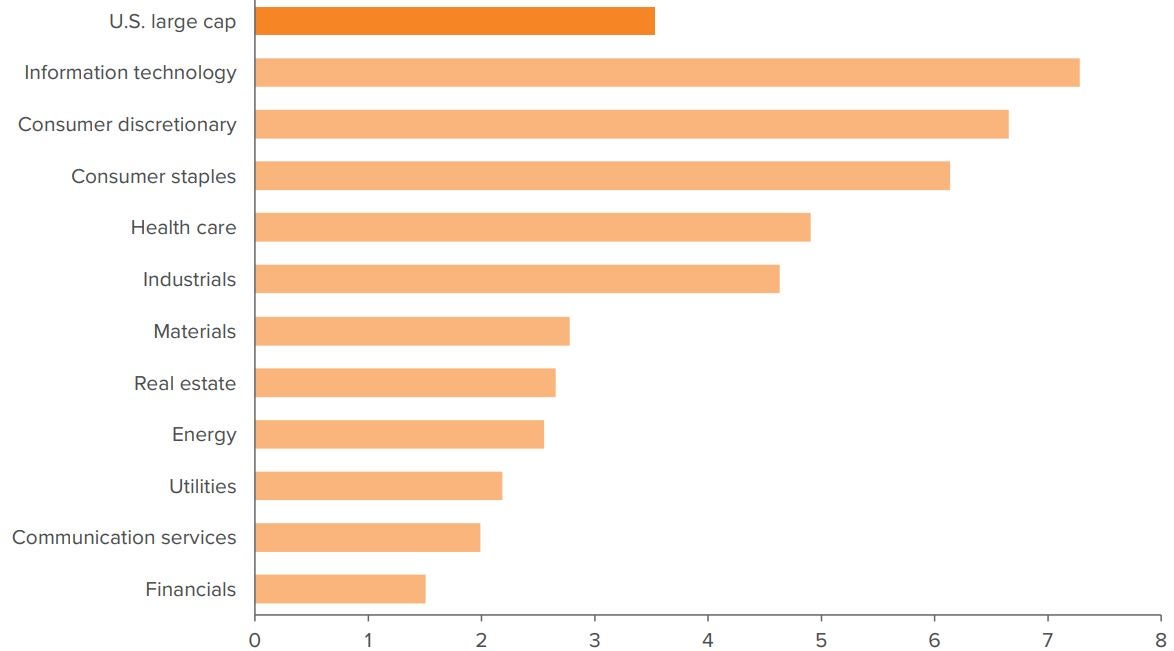

A case in point is the aforementioned book-to-price, a valuation factor built for the industrial age. Exhibit 4 shows its efficacy for selection among U.S. large capitalization stocks since 1985, by sector. The factor has worked well for energy stocks, for which the book value of reserves is indeed a key consideration in a company’s valuation. It has shown some relevance for industrials, consumer staples and utilities, where manufacturing plants and equipment may well put a floor on the share price. In contrast, among sectors driven by innovation such as information technology and communication services, stocks that looked attractively priced based on the book value of their assets historically have underperformed meaningfully.

The reason is related to outdated accounting practices tailored to “old economy” industries. While capital expenses are treated as investments that add to a stock’s asset base, funds spent on research and development (R&D) are treated as expenses and not reflected in book values. Similarly, advertising campaigns for consumer-facing companies are expensed when they may contribute to building a strong “brand value” to lever well into the future. For many health care stocks, both R&D and marketing contribute to considerable intangible assets not represented on GAAP-conforming balance sheets. Recent academic research confirms that capitalizing historical R&D and advertising expenses in the calculation of book-to-price enhances its efficacy for stock selection.4

As of 12/31/22. Source: FactSet (returns, GICS, Russell 1000 Index constituents) and Axioma (book-to-price and industry classification when GICS missing), analysis by Voya Investment Management.

Accounting issues plague the book-to-price factor in other ways:

- Its adverse performance for real estate investment trusts (REITs) is caused by the mandatory depreciation of real estate holdings eating away at their book values, while fair market values may have increased. This issue also affects companies with heavy real estate holdings, such as department store chains. The proper measure of accounting for stocks’ real estate holdings is by their estimated net asset value.

- Its surprising irrelevance for differentiating future returns among financials is likely related to the subjectivity and misaligned incentives of valuing ever more complex financial instruments. For example, banks were slow to take write-offs ahead of the global financial crisis. Such subjectivity increasingly impacts the financial statements in any line of business, in ways both old (allowances for merchandise returns by retailers) and new (the impact of climate change on reinsurers and assets “stranded” by carbon pricing for energy companies and miners).

- Premiums paid for mergers create intangible goodwill on companies’ balance sheets. Given the tendency of serial acquirers to overpay, these may well have to be written off in the future. Accordingly, academic research has shown that goodwill negatively predicts future stock returns.5

- Stock buybacks of successful companies, typically at higher prices than the nominal value of the shares when first issued, have mechanically led to negative book values of equity for some well-known firms. Research has shown that valuation metrics based on retained earnings rather than contributed capital are better predictors of future stock returns.6

Book-to-price has long been the workhorse of academic finance, but is now even rejected by its original proponents. After changes in the market environment since the original research, and adding new growth and profitability factors to their asset pricing model, Fama and French’s original definition of this value factor was no longer found to have delivered a return premium historically.7 The investment industry, however, has been slower to adapt. Billions of dollars are invested in active indexes that indiscriminately use this factor across all sectors,8 even though this stock selection criterion is irrelevant for a growing swath of the market.

Smart beta is sometimes described as a “third pillar of investing between passive and active.” In our view, there is potentially a “fourth pillar” to complete the edifice: “systematic, active factor investing” (Exhibit 5), with proprietary factor definitions and efficient portfolio implementation intended to outperform generic factor indexes.

Source: Voya Investment Management.

Supplementing factors with fundamental insight

Incorporating fundamental insights potentially makes factor strategies more effective.

The “new economy” is increasingly knowledge based, due to networking effects and the dominance of global brands. Fortunately, the same technological and societal trends driving changes in the market environment also allow us to redefine “value” accordingly.

For example, patent databases shed light on firms’ intellectual property while social media chatter helps measure companies’ brand relevance, allowing for better assessment of a business’s intangibles. Financial databases provide better information to investors about loan delinquencies for banks, as well as the cash flow from REIT property portfolios. Increasingly common environmental, social and governance (ESG) disclosures shed light on the non-financial balance sheets of companies. The key challenge to investors is defining the numerator of valuation ratios to better reflect business prospects than the generic value factors prevalent today do. Importantly, it is exactly intangibles such as innovation that may provide the catalysts for beaten-down value stocks to reverse their fortunes.

A key consideration for relative valuation strategies is the definition of proper peer groups. For instance, the energy sector generally trades much closer to book value than information technology (Exhibit 6). Using book-to-price only for security selection within sectors mitigates this inherent bias, as in the analysis above and some factor indexes, but may be insufficiently granular. For instance, the asset-light software and services segment within the information technology sector would appear structurally more expensive than hardware and semiconductors on this valuation metric, but it would be unlikely to consistently represent an inferior investment opportunity.

As of 12/31/22. Source: FactSet, R1000 sector P/B weighted harmonic means.

Focus on outcomes

The next frontier is to build outcome-oriented factor strategies.

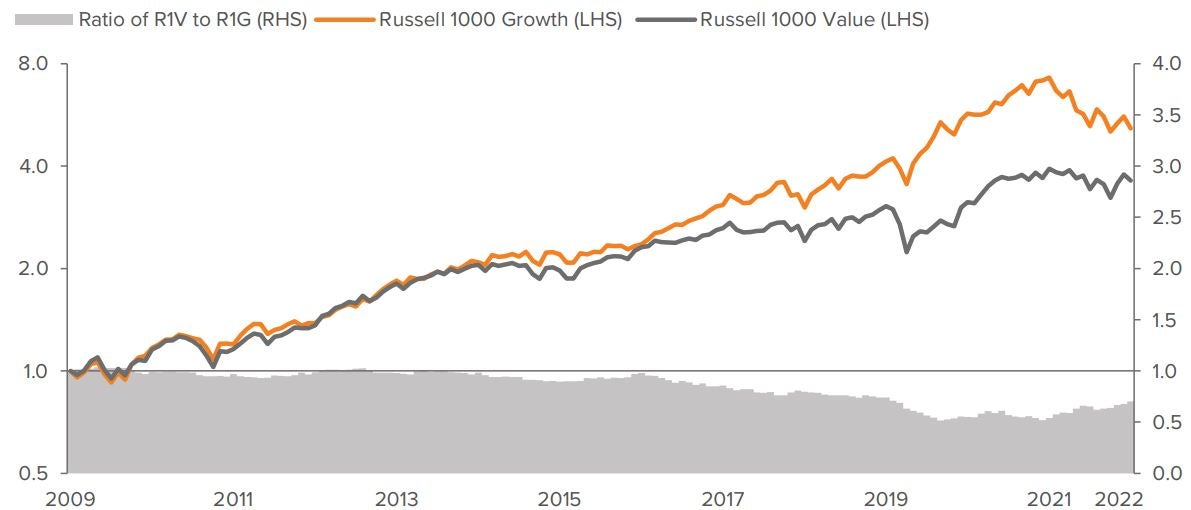

Despite more than half a decade of underperformance by value investing (Exhibit 7), rumors of its demise might be premature, since price does matter. Fundamentally, there are two components to any investment: a stake in a business and the amount paid for it. If the history of human behavior is any guide, investors will remain prone to overpaying for the shiny but distant growth prospects of “glamor stocks,” and will show less interest in more established, but unexciting firms. The strong performance of value stocks compared to growth stocks since 2020 offers support to this thesis.

As of 12/31/22. Source: the Frank Russell Co., analysis by Voya Investment Management.

To be effective, we believe factor investing strategies should be both contextual, i.e., able to take into account differences across business segments, and adaptable as markets change over time. They should reflect the many insights that can be taken from fundamental investors as to what differentiates the prospects of stocks within a specific industry. In our view, integrating such fundamental stock selection insights into a systematic strategy through careful research and targeted data acquisition is what constitutes a truly effective factor investment strategy. In short, Voya constructs factors to systematically invest in stocks, rather than using stocks to load on factors.

The next frontier for factor-based investing is to devise strategies with the potential to deliver on investment outcomes and investor needs, rather than just aiming to outperform a benchmark. For example, strategies with a high dividend payout but low volatility may be particularly attractive for investors in the decumulation phase of retirement planning, i.e., through retirement, when they need both income and growth, but cannot take on the full risk of a sudden equity market downturn. Ultimately, what matters is not the labeling of a strategy, but whether it contributes to meeting clients’ investment objectives in a risk-managed and cost-effective manner.

Factor investing for the information age

We have already discussed the necessity of updating the definition of valuation ratios to remain relevant for today’s economy, with companies’ earnings power increasingly relying on intangible assets such as intellectual property rather than physical assets such as plant, property and equipment.9 Similarly, the data and techniques used for effective factor investing have evolved from using linear models based on traditional financial data to nonlinear machine learning based on alternative data sources.

“Alternative data” is a poorly defined notion but generally refers to data not sourced from financial markets or companies’ financial statements. It’s often enabled by new technologies or companies realizing they can monetize proprietary data they collect in the course of their core businesses. To give just one example: While in the past financial analysts may have visited mall parking lots to gauge store traffic during the holiday season, now they can rely on vendors parsing satellite imagery of parking lot occupation rates as well as monitoring foot traffic based on shoppers’ mobile phones. This can be supplemented by data from payment processors to provide insight into trends in consumers’ credit card spending. Near -real-time information from sources such as these can help predict store chains’ earnings well ahead of their quarterly earnings release and thus create the foundation of a better, more forward-looking valuation or growth factor.10

Alternative data can also move beyond structured tabular data into unstructured text data by applying natural language processing (NLP) techniques. For instance, a positive tone by management during a company’s earnings call can strengthen conviction around the reported earnings and growth projections that are traditionally captured in multi-factor models.11 The recent leap in NLP capabilities from the advent of large language models (LLM) will only accelerate the potential to enhance factor models by processing textual input from a wide range of sources, be it company communications, news stories, customer reviews, social media or whatever else seems material to better gauge a company’s prospects.

Lastly, while the original multi-factor models were often scorecards of individual factors with weights estimated through linear regression, the wide availability of machine learning packages and computing power enables analysts to move beyond linear calculations to capture nonlinearities and interactions in a factor’s relationship to future stock returns. Our investment intuition tells us such effects are real and factor payoffs are not all linear. For example, while stocks with an attractive dividend yield have over the long run outperformed, stocks with the very highest dividend yields tend to be distressed and don’t do as well.12

For interaction effects, we have already discussed how a valuation metric based on the book value of tangible assets may not be relevant for new-economy stocks. As an additional example, research has shown that heavy investment in growing a business does not generally pay off for investors,13 but we’d surmise this may be different for highly profitable companies. Machine learning allows the systematic exploration of such nonlinearities and interactions, though we remain mindful of the risk of data mining and will prefer models for which we retain a fundamental intuition. Taking the evolution of factor investing to its furthest extent, this process eventually moves beyond applying machine learning to enhance multi-factor models into using artificial intelligence (AI) to create “virtual fundamental analysts.”

While the exact shape of factor investing may change, our conviction on the potential of the right approach — cutting-edge quantitative research supported by empirical analysis and sound fundamental investment intuition — does not.

Factor investing is integrating machine learning and artificial intelligence to develop “virtual fundamental analysts.”

Bibliography

Ang, A., W. Goetzmann, and S. Schaefer (2009) “Evaluation of Active Management of the Norwegian Government Pension Fund – Global,” report to the Norwegian Ministry of Finance.

Ball, R., J. Gerakos, J. Linnainmaa, and V. Nikolaev (2019) “Earnings, retained earnings, and book-to-market in the cross section of expected returns,” Journal of Financial Economics (to appear).

De Boer, S., M. LaBella and S. Reifsteck (2016) “A Taxonomy of Beta Based on Investment Outcomes,” Journal of Index Investing, Vol. 7 (1) pp. 92–115.

Fama, E. and K. French (1992) “The Cross-Section of Expected Stock Returns,” The Journal of Finance, Vol. 47(2) pp. 427–465.

Fama, E. and K. French (2015) “A Five-Factor Asset Pricing Model,” Journal of Financial Economics, Vol. 116 (1) pp. 1–22.

Graham, B. and D. Dodd (1934), Security Analysis, Whittlesey House.

Hou, K., C. Xue, and L. Zhang (2015) “Digesting Anomalies: An Investment Approach,” Review of Financial Studies, Vol. 28 (3) pp. 650–705.

Lev, B. and A. Srivastava (2019) “Explaining the Demise of Value Investing,” working paper, available at SSRN: https://ssrn.com/abstract=3442539

Liu, X., C. Yin, and W. Zheng (2019) “The Invisible Burden: Goodwill and the Cross-Section of Stock Returns,” Behavioral Finance Working Group Conference, Queen Mary University of London.

Jegadeesh, N. and S. Titman (1993) “Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency,” The Journal of Finance, Vol. 48 (1) pp. 65–91.