A new form of financing – commercial property assessed clean energy (CPACE) – to help property owners reduce energy consumption is gaining momentum, offering investors potentially attractive yields and aligning with ESG interests.

Highlights

- Commercial property assessed clean energy (CPACE) finance increased from $54 million to $2.1 billion between 2013 and 20201

- CPACE can help to diversify a property loan book and help move portfolios in a more ESG-aware direction

- To date, 37 US states and the District of Columbia have passed CPACE legislation, enabling the use of this type of lending

Environmental regulations driving massive need for financing

With all the focus on auto emission standards in the race to slow climate change, buildings and manufacturing plants remain by far the largest offenders, accounting for two-thirds of America’s carbon dioxide emissions.2 As a result, many state and local regulators are putting intense pressure on commercial property owners to make their buildings more energy efficient and introduce renewable energy improvements. For example, New York City has mandated that owners of larger properties must reduce emissions 40% by 2030 and 80% by 2050.3

Retrofitting buildings to meet these mandates will likely require prohibitive investments by landlords and/or tenants, depending on the lease structure. If these types of regulations become more common, it could put property owners with older, inefficient assets at an even greater disadvantage in signing new leases.

This is where the CPACE model comes in. PACE financing for residential properties has already proven effective for homeowners. But recent progress in the commercial sector is where we see the most potential for investors, creating a stream of high-yielding opportunities that align with the growing focus on environmental, social and governance (ESG) investing.

Allowing long-term repayment for efficiency upgrades

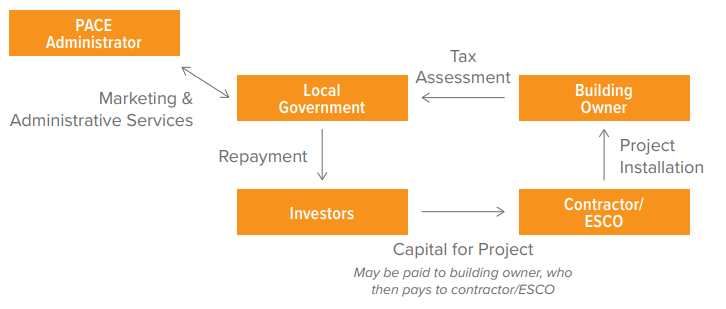

In the CPACE model, investors provide the upfront capital needed for energy efficiency or other eligible projects, offering long-term repayment options to the property owner. Funds are typically paid directly to a construction contractor for installing eligible improvements, from upgrading lighting, plumbing, heating, ventilation and air conditioning systems, to installing solar panels. Some programs also allow non-energy measures such as earthquake protection.

According to PACENation, 37 U.S. states and the District of Columbia have passed CPACE legislation through 2021. States act as the facilitator and administrator of CPACE, but they do not usually provide direct subsidies. Details depend on the program, but the investors typically pay a building contractor, and a local government tax assessment repays the lender(s) in full. Private financial institutions typically provide the capital (see diagram), which provides an opportunity for banks and investment managers such as Voya Investment Management (Voya IM).

Source: Better Buildings, U.S. Department of Energy.

CPACE investors are guaranteed to receive the promised income stream, as building owners must repay the borrowed capital via a real estate tax assessment. However, a default could disrupt cash flows just as it can for commercial mortgages. The key difference between a CPACE loan and a mezzanine loan is that the senior mortgage holder cannot accelerate the note, as the existing senior lender subordinates to the CPACE loan. Therefore, the senior and CPACE lenders would wait for repayment together.

CPACE loans attach to the property rather than to the owner, and transfer with the sale of the property even if the former owner becomes bankrupt. CPACE loans are non-recourse, with the building pledged as collateral, and are senior to many other forms of collateral.

Since CPACE finance can only be used for eligible energy-efficiency improvements, the bulk of financing for the property is still raised in more conventional forms (unless the property is mortgage free). Despite their seniority to senior mortgage debt, CPACE loans currently offer higher yields than mortgages; as of December 2021, CPACE loans were priced at a premium to senior loans. In our view, this segment of the market – perhaps because it is so novel and therefore not widely known – represents an opportunity for relatively rich returns.

Again, the current environment seems to benefit all involved as, from the borrower’s point of view, it is still generally cheaper to secure CPACE financing for these improvements and retrofits than alternatives such as mezzanine finance or preferred equity. So, while investors may receive a higher yield for lending capital within the CPACE structure, borrowers benefit from having a cost-effective way to blend their financing sources and make energy-efficiency improvements that are increasingly becoming requirements.

Gathering PACE

Residential PACE was first introduced in 2007, while CPACE programs began to appear in 2009. Momentum in CPACE has started to pick up in recent years. In 2013, just $54 million was cumulatively invested, while by 2020 the level of financing made available in this structure surged to almost $2.1 billion. This capital has been invested in 2,560 commercial projects nationwide, with energy efficiency making up 49% of the investments and renewable energy representing 23%. California has so far led the way with a cumulative investment tally of $625 million.

For investment managers, meanwhile, CPACE can help to diversify a property loan book and help move portfolios in a more ESG-aware direction. The lender providing the construction or mortgage loan could also agree to the CPACE loan and include both loans in its fund. Indeed, this can provide greater transparency and help address any concerns about the conventional lender being lower down the seniority chain when it comes to repayments.

The senior mortgage holder could object to an additional CPACE loan – as it effectively increases leverage on the property. However, if the senior mortgage lender is the same entity as the CPACE lender, this obstacle is removed. Whether or not the same lender originates the CPACE and mortgage, the loans could also be separated into different investment funds.

At Voya IM, we are still evaluating CPACE loans, but the prospects of a gross yield in the 8-9% range combined with their seniority to traditional senior mortgages on the property have us optimistic about the space, with the ESG attributes as a bonus.

Hospitality hotspot

Hospitality has been the largest recipient of CPACE finance, offering the clearest potential for this burgeoning area of loan investments:

- Hotels regularly need updating and modernising, especially as they get to an advanced age, to comply with tightening energy efficiency regulation. Properties that do not comply must undertake a Property Improvement Plan, which can require significant capital

- Hotels consume copious amounts of energy – and since energy costs cannot realistically be passed on to customers in a competitive market, better energy efficiency can substantially improve margins

- Hotel groups need capital to upgrade newly purchased hotels, to bring them in line with other hotels in their portfolio

In short, the goals of increasing energy efficiency and profitability are aligned, which makes hospitality well suited for CPACE finance to grow as a means of borrowing.

Niche but growing

The CPACE sector is still in the early stages of growth, but we see meaningful potential, as additional states are planning CPACE-enabling legislation and energy efficiency requirements are only moving in one direction. Because states and cities have their own building codes, the evolution of CPACE finance will likely vary in different parts of the country. These codes will likely determine what sort of energy efficiency measures are in demand and therefore what types of CPACE opportunities may arise.

Requirements in certain geographies and commercial sectors could soon extend to stipulations that buildings must receive their energy from renewable sources. For example, the California Energy Commission’s five-member panel recently voted unanimously in favour of requiring solar panels and battery storage in new commercial buildings starting in January 2023. Such requirements should only be positive for the overall growth of the CPACE sector.

Although the most obvious environmental, social and governance (ESG) benefit is on the environmental side, we see potential social benefits as well. Just as CPACE finance could be applied to increase the energy efficiency of low-income rental housing, it could potentially reduce utility bills for residents. In addition, the by-product of any enhancement could improve living conditions for occupants.

While the sector remains at an early stage, we believe the growth trajectory is likely to be replicated across much of the US, creating new opportunities for fixed income investors